每周全球金融观察 | 第 144 篇:大分歧:货币政策、经济增长和投资回报

来源:岭南论坛 时间:2023-06-26

在大西洋彼岸,英国央行周四加息 50bp(市场预期为 25bp),令市场感到惊讶,这是英国央行自 2021 年 12 月以来连续第 13 次加息,使基准利率达到 5%。事实证明,英国的通货膨胀特别顽固,5 月 CPI 同比增长 8.7%(核心是 7.1%),而美国是 4.0%。

英国央行行长 Andrew Bailey 在加息后的评论 "我们并不期待,也不希望出现经济衰退,但我们将采取必要的措施,将通胀率降至目标。"这并没有给人带来任何信心。

周四,欧洲其他地方出现了更多的加息动态,瑞士央行将其政策利率提高了 25bp 至 1.75%,而挪威中央银行(Norges Bank)将基准利率提高了 50bp 至 3.75%,并暗示将有更多的加息。

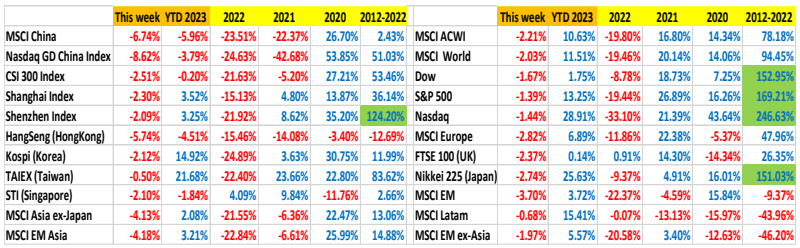

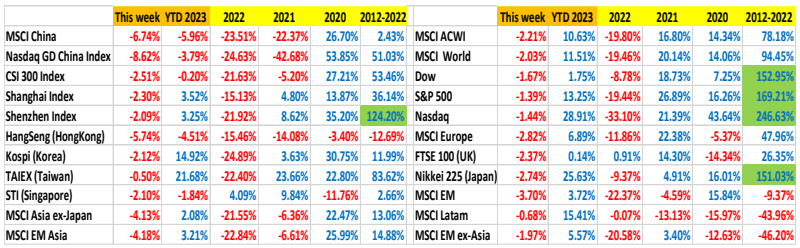

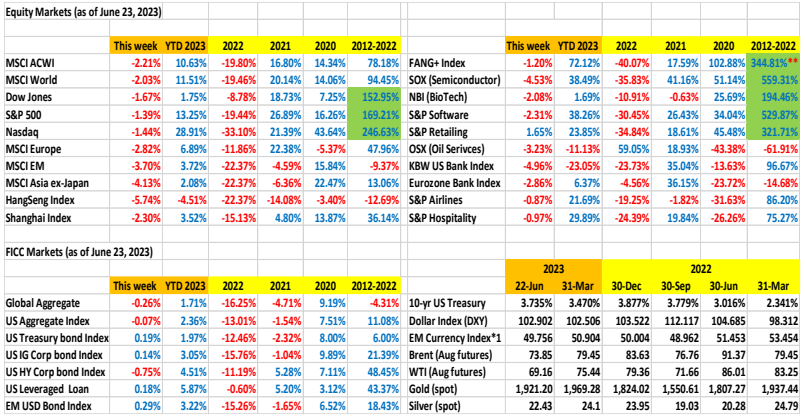

美国的加息周期可能已经走到了尽头(7 月是否再加 25 个基点没什么大不了),而英国和欧洲大陆可能还有相当长的路要走,中国在积极降息。货币政策的分歧正在与经济增长对接,美国的经济衰退总是延迟 3 个月(Janet Yellen 周四表示,美国陷入衰退的几率已经降低),而欧洲的衰退风险(再加息)正在升级。货币政策和经济的分歧明显体现在股市回报上,纳斯达克和标普 500 指数年初至今分别上涨 28.91%和 13.25%,而欧洲 STOXX 600 指数 YTD 上涨 6.65%,英国的 FTSE100 指数基本持平,为 0.14%。MSCI 中国指数 YTD 的回报率是令人失望的 -5.96%。

纳斯达克指数、标准普尔 500 指数、斯托克 600 指数、富时 100 指数、MSCI 中国指数:YTD 回报:

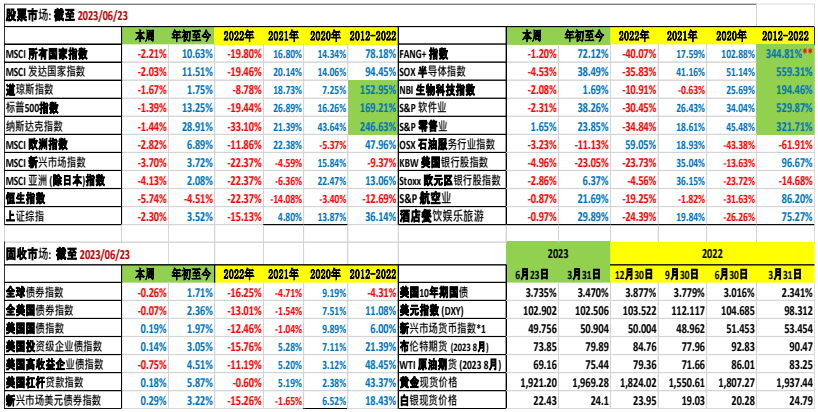

请参考下表,2023 年全年的表现与往年的对比:

所有数据截止到 6 月 23 日, *1 截止到 6 月 22 日

我们将何去何从?

奥马哈的神谕知道什么是我们不知道的?

奥马哈的神谕(Warren Buffett)在 2022 年对日本进行了罕见的大规模投资,投资于五家日本贸易公司(伊藤忠、丸红、三井物产、三菱商事和住友商事),并在 2022 年底前将其在每家公司的持股量增加到 5%,到 2023 年第一季度进一步增加到 7.4%。本周,有消息称,这位圣人已将在这五家公司的持股比例提高到 8.5%。

伊藤忠、丸红、三井物产、三菱公司和住友公司:自 2022 年 1 月 4 日以来的涨幅:

VIX(又称恐惧指数)刚刚达到 2020 年 1 月以来的最低水平:

华尔街所谓的 "恐惧指数"--芝加哥期货交易所 S&P500 波动率指数周四跌至 12.73,是 2020年 1 月以来的最低点。VIX 指数也许因其在市场动荡时期的大幅飙升而最为著名(2020 年 3月)。但持续的、较低的指数是牛市的一个标志。

然而,利率波动性显示出不同的情况。MOVE 指数已经远远脱离了今年 3 月的高点(SVB 和瑞信之后),但相对于 2020 年大流行之后的平静期,仍然相当高。MOVE 指数告诉我们,预计会有更多的利率波动。

收益率曲线倒挂:

2 年期-10 年期美国国债收益率倒挂(100bp)是 2023 年 3 月以来的最高水平(107bp),尽管银行业系统性风险已经不存在。同样,3 个月国债对 10 年期美国国债的收益率为 156bp,是自 2023 年 3 月(SVB 事件后升至 186bp)的最高水平。4自 2022 年 7 月以来,许多市场专家和媒体都认为,收益率曲线倒挂是即将到来的经济衰退的前兆。如果我们已经押注并继续押注美国经济衰退的主题(做空股票),那么痛苦很可能会达到无法招架的地步。我从 2022 年 7 月起就一直认为,收益率曲线反转指标从 80 年代中期起就已经过时了,不再具有预测能力。使用一个过时的工具进行预测可能是灾难性的和致命的。世界已经改变了。美国财长(前美联储主席) Janet Yellen (aka “the Fairy godmother of bull market”,又名“牛市的仙女教母”)周四表示,美国陷入衰退的几率已经减少。

永远不要说这不会发生在我们身上:

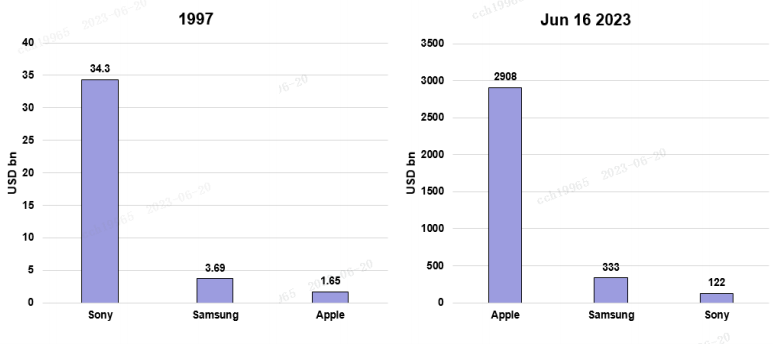

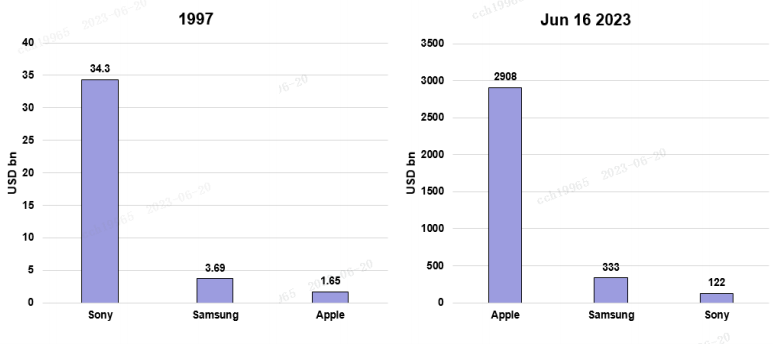

我们中的一些人可能记得,是索尼 (Sony) 在 1979 年发明了便携式音乐播放器(Walkman)。是苹果公司通过 iPod 将这一概念推向了新的高度,然后是 iPhone,然后是 iMac ....。剩下的就是历史了。

1997 年,索尼的市值(343 亿美元)是苹果(16.5 亿美元)的 20.8 倍。2023 年 6 月 16日,苹果的市值(2.908 万亿美元)是索尼(1220 亿美元)的 23.8 倍。

累积收益图将更清楚地说明这种对比。选错了马(或选错了火车)不仅会让你一无所获,而且可能是致命的。

苹果(99462%)、三星(8873%)、索尼(238%):1997 年 1 月 2 日以来的累计回报率:

选择赢家,并以最佳的资产配置(战略和战术),是至关重要的。在最初的几年里,这可能并不明显,但随着盈利倍数的增加,差别是天壤之别。投资成功的关键是认识到不断变化的动态,并相应调整我们的投资。

我记得一句经典的英语 -“It is no use flogging a dead horse.”- "鞭打一匹死马是没有用的"。在投资方面,选择长期赢家是很重要的, 如果你想成为赢家。

作者:蔡清福

Alvin C. Chua

2023 年 6 月 25 日, 星期日

东亚和中国股票市场的表现与全球同行的比较:

Article #144: The Great Divergence: Monetary Policy, Economic, and Investment Returns

Fed Chairman Powell appeared on Capitol Hill this week for his two-day semi-annual testimony before the House Financial Services committee and the Senate Banking committee. It was an outwardly hawkish performance. Chairman Powell reiterated that another rate hike in July “a couple of rate hikes” are still likely, and that the Fed will be data dependent (why not).

Across the Atlantic, the Bank of England surprised the market with a 50bp rate hike on Thursday (market was expecting 25bp), which was BOE’s 13th consecutive rate hike since Dec 2021, bringing the benchmark rate to 5%. The inflation in the UK has proved particularly stubborn with May CPI rising 8.7% YoY (core 7.1%), vs 4.0% in the US.

BOE Governor Andrew Bailey’s post rate hike comment “We’re not expecting, we’re not desiring a recession, but we will do what is necessary to bring inflation down to target.” is not instilling any confidence.

There were more interest rates surprises elsewhere in Europe on Thursday, with the Swiss National Bank lifting its policy 25bp to 1.75%, while Norges Bank (Central Bank of Norway) raised benchmark rate by 50bp to 3.75%, and signaled more hikes to come.

The rate hike cycle in the US is likely to have reached the end (whether another 25bp hike in July won’t move the needle), while UK and continental Europe are likely to have quite a distance to go, and China is actively cutting rates. The monetary policy divergence is dovetailing with economic growth, with the recession in the US always a 3-month delay (Janet Yellen said on Thursday that the odds of US tipping into a recession have diminished), while the recession risk in Europe (with additional rate hikes) is escalating. The monetary policy and economic divergence are clearly manifested in the stock market returns, with the Nasdaq and S&P500 gaining 28.91% and 13.25% respectively YTD, while the European STOXX 600 index is up 6.65% YTD and the FTSE100 in the UK is basically flat at 0.14%. The MSCI China has a disappointing -5.96% return YTD.

Nasdaq, S&P500, Stoxx 600, FTSE100, MSCI China: YTD return:

The sage of Omaha (Warren Buffett) made his rare sizable investment in Japan in 2022, investingin five Japanese trading companies (Itochu, Marubeni, Mitsui & Co, Mitsubishi Corp, and Sumitomo Corp) and increased his stake to 5% in each company by the end of 2022, and further increased to 7.4% by Q1 2023. This week, there was news that the sage has raised holdings in these five companies to 8.5%.

Itochu, Marubeni, Mitsui & Co, Mitsubishi Corp, and Sumitomo Corp: % gain since Jan 4, 2022:

VIX (aka fear index) just hit the lowest level since January 2020:

Wall Street's so-called "fear index" — the CBOE S&P500 Volatility Index fell to 12.73 on Thursday, the lowest reading since January 2020. The VIX is perhaps most famous for its skyward spikes during periods of market turmoil (March 2020). But sustained, lower readings are a hallmark of bull markets

However, interest rate volatility shows a different story. The MOVE index is well off its highs in March this year (post SVB and Credit Suisse), but nevertheless remains quite elevated relative to the period of calm after the 2020 pandemic. The MOVE index is telling us to expect more interest rate volatility.

Yield curve inversion:

The 2yr-10yr US Treasury yield inversion (at 100bp) is at the highest level since March 2023(107bp), despite the banking systemic risk being off the table. Same for the 3-month T-bill vs 10-yr UST at 156bp, is at the widest since March 2023 (post SVB implosion) at 186bp. 4Many market pundits and media have argued since July 2022 that the yield curve inversion is a precursor to impending recession. If one has bet, and continuesto bet on the US recession theme (shorting equities), the pain is likely to reach the capitulation point. I have been arguing since July 2022 that the yield curve inversion indicator has been outdated since the mid-1980s, and no longer has the predictive power. Using an outdated tool for forecasting can have disastrous consequence. The world has changed. Janet Yellen (aka the “Fairy godmother of bull market”) said on Thursday that the odds of US tipping into a recession have diminished.

Never say this won’t happen to us:

Some of us may remember it was Sony that invented the portable music player (Walkman) in 1979. It was Apple who took the concept to the next level with the iPod, then the iPhone, then the iMac …. And the rest is history.

In 1997, Sony’s market cap (US$34.3 billion) was 20.8x that of Apple (US$1.65 billion). On June 16, 2023, Apple’s market cap (US$2,908 billion) was 23.8x that of Sony (US$ 122 billion).

A cumulative return graph will more clearly illustrate the contrast. Picking the wrong horse (or the wrong train) can get you nowhere and may be deadly.

Apple (99,462%), Samsung (8,873%), Sony (238%): cumulative return since Jan 2, 1997:

Picking winners, and with the optimal asset allocation (strategic and tactical), is of utmost importance. It may not be obvious for the first few years, but as the winning multiples, the difference is day and night. The key to investment success is to recognize the changing dynamics, and to adjust our investments accordingly.

I remember a classic saying -- “It is no use flogging a dead horse.” In investments, it is important to pick long-term winners, if you want to be a winner.