每周全球金融观察 | 第 143 篇:谁动了我的奶酪

来源:岭南论坛 时间:2023-06-19

作者:蔡清福

Alvin C. Chua

2023 年 6 月 18 日, 星期日

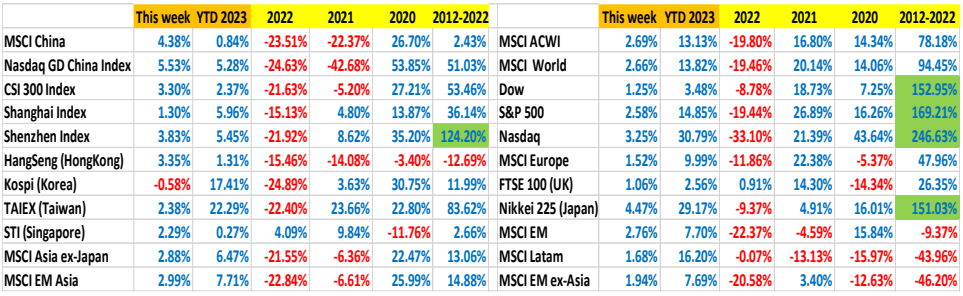

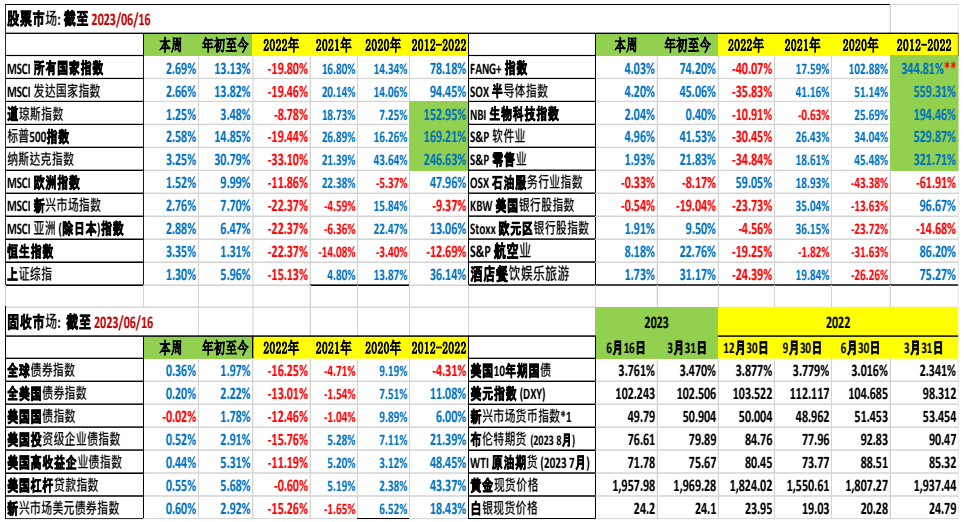

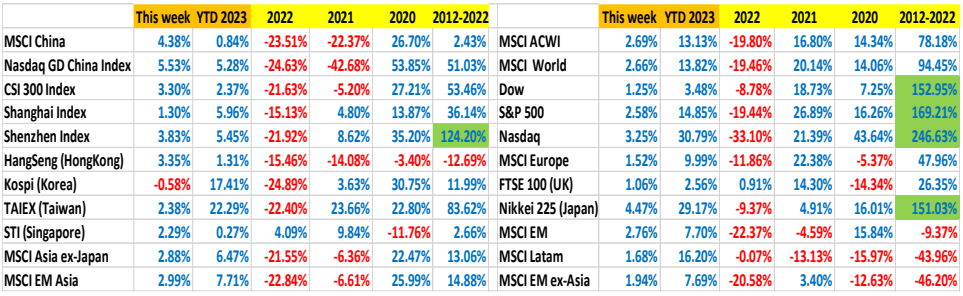

东亚和中国股票市场的表现与全球同行的比较:

Article #143: Who Moved My Cheese

The May US CPI data reported on Tuesday was encouraging, increased by 0.1% MoM in May, below the 0.2% consensus estimate and slower than April’s 0.4%. YoY, the CPI was 4.0%, down from the 4.9% pace in April. Please note, the May CPI increase is less than half of 9.1% in June 2022.

The overall inflation trend is one of continuing progress toward more benign inflation, although far away from the Fed’s 2% target (core PCE deflator). I would note, the 2% is a target, not cast in stone nor legislated.

The Fed is right to skip a rate hike the next day on June 14. After 10 rate hikes since March 2022, which brought overnight interest from 0% to 5.00%-5.25%, it was the 1st FOMC out of 11 meetings without a rate hike. Although the Fed hinted possibilities of additional rate hikes if inflation continues to be stubborn, or the economy continues to be overheated (politically correct statements). Perhaps pause and pivot are the right conclusions? Perhaps May 3 was the last rate hike?

Across the Atlantic, the ECB diverged from the Fed and on Thursday nudged benchmark rate higher by 25bp to 3.5%, the highest level in 22 years. At the post meeting press conference, ECB president Christine Lagarde commented “We are not thinking about pausing”, “Unless there is a material change to the baseline forecasts, we would hike rates again in July”. The ECB’s assertiveness in battling inflation illustrates the ECB determination to maintain price stability at the expense of economic growth, notably with the Eurozone inflation at 6.1%, above that in the US.

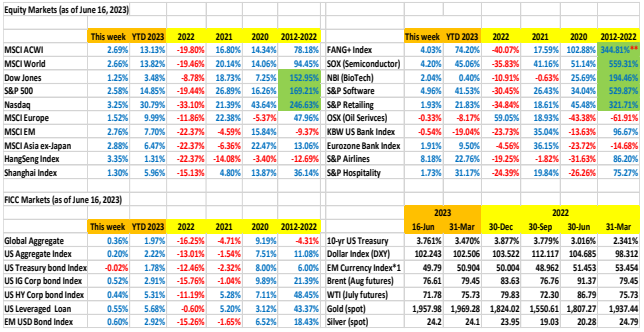

It was a great week for the global equity markets. After officially ending the 248-day bear market (the longest since 1948) last week, the S&P500 reached a new milestone on Monday, making a new 52-week high without pausing, leaving market bears in the dust. For the week, the Dow, 2S&P500, and Nasdaq gained 1.25%, 2.58% and 3.25% respectively, YTD gains were +3.48%, +14.85% and +30.79% respectively. Notably, the FANG+ index and the SOX (semiconductor index) gained 74% and 45% respectively YTD.

The Nikkei-225 had an unstoppable week, gaining 4.47% this week after a 2.35% gain last week. YTD, Nikkei-225 has gained 29.17%.

In fact, this week (and YTD 2023) has been notable for global equity out-performance, across geographic regions and industries.

Nasdaq 100 Index (+37.88%), Nasdaq Composite Index (+30.79%), Nikkei 225 Index (+29.17%), S&P500 (+14.85%), MSCI Europe (+9.99%), MSCI China (+0.84%):

Please refer to the following table for YTD 2023 performance vs prior years:

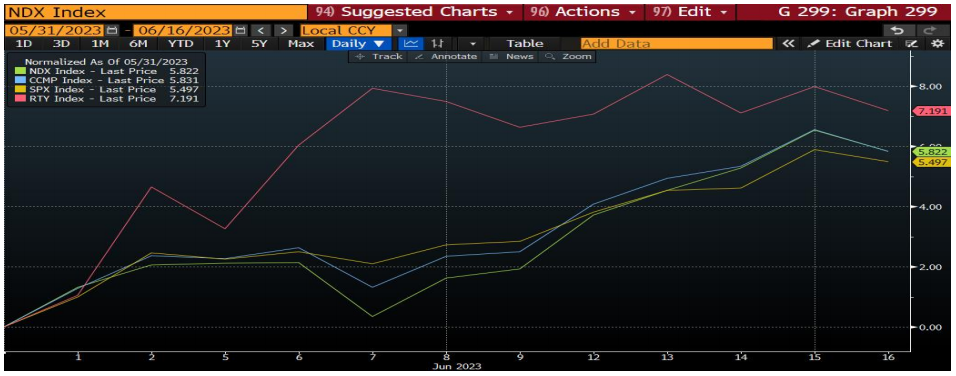

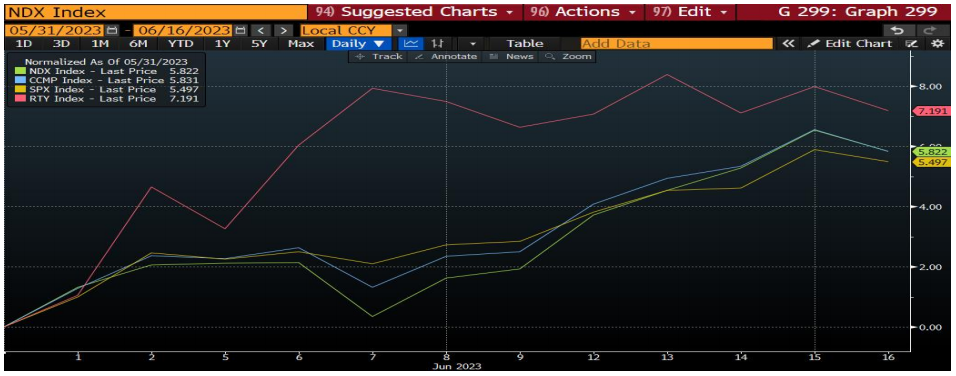

Since mid-May, the tech sector has led the bull market rally, notably Nvidia (+192% YTD), FANG+ index (+74% YTD), and Nasdaq 100 Index (+37.88% YTD). Since the start of June, the rally has spread to a broader industry, even the small caps.

The Russell 2000 index is comprised of the smallest 2000 companies in the Russell 3000 index, representing 8% of the Russell 3000 total market cap (top 1000: 92%, bottom 2000: 8%). The small-cap companies are often regarded as a bellwether for broader economic expectations. Month-to-date, the Russell 2000 index has outpaced the Nasdaq 100, Nasdaq Composite as well as the S&P500 indices. The bull market has spread … The Russell 2000 outperformance is also an indication that investors are getting over the March/April US banking crisis (SVB, First Republic).

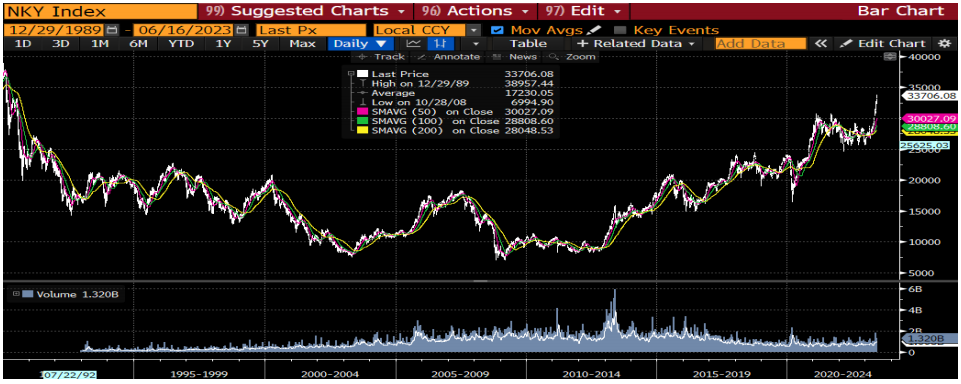

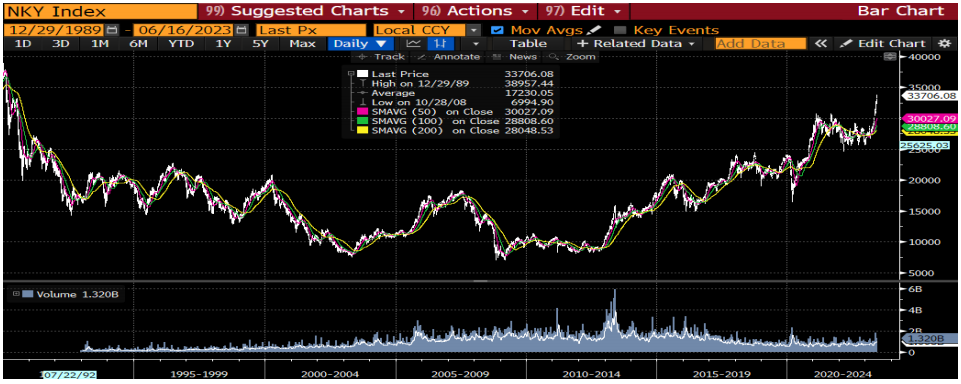

The unstoppable Nikkei-225:

The Nikkei-225 Index has gained 29.17% YTD, and 9.12% so far in June. It seems improbable at the start of 2023. Many of us would remember that the Nikkei-225 Index peaked on December 29, 1989 (33.5 years ago) at 38,957.44. On Friday June 16, it closed at 33,706.08

For many years during the mid-1990s through mid-2010s, the Nikkei-225 was in absolute doldrums, forgotten and given-up by the global investment community. Any meaningful recovery was met with selling. The phrase “Asia-ex-Japan” was created.

The sage of Omaha (Warren Buffett) made his rare sizable investment in Japan in 2022, investingin five Japanese trading companies (Itochu, Marubeni, Mitsui & Co, Mitsubishi Corp, and Sumitomo Corp) and increased his stake to 5% in each company (increased to 7.4% by Q1 2023). The sage funded the investment in Yen, swapped to USD (without currency risk) at 0.5% USD equivalent cost. At the time of investments, the dividend yields of these companies were in 5-6% area. The following graph on cumulative return (assuming it started on Jan 01, 2022) is absolutely illuminating.

Perhaps this time it will be different. We should listen to the wisdom of the sage.

Who moved my cheese?

Newton's first law states that every object will remain at rest or in uniform motion in a straight line unless compelled to change its state by the action of an external force.

The 1st, 2nd, 3rd, and 4th and future industrial revolutions are external forces that changed geopolitical dynamics, economic power, industries, corporate landscape, as well as family fortunes. The rapid adoption of and adaptation to internet over the past quarter century has spawned all kinds of innovations that permeated to every aspect of our lives, and well as corporate businesses. The corporate graveyard is full of once venerable companies who havebeen displaced (disrupted) by the internet or failed to adapt and embrace the internet. There was the buzz word “would you rather disrupt or be disrupted”?

Joseph Schumpeter (the Austrian born political economist, briefly served as Finance Minister of German-Austria in 1919, and from 1932 until his death in 1950, was an economics professor at Harvard University) would have argued it is “creative destruction”. Schumpeter is regarded as 5one of the greatest intellectuals of the 20th century, coined the term “creative destruction” to describe how the old is being constantly replaced by the new.

Many of us have used the term “paradigm shifts” indiscriminately, but not many know where the word came from. It was American physicist and philosopher Thomas Kuhn who coined the term “paradigm shift” in his influential book “The Structure of Scientific Revolutions” in 1962, to describe a major change in how people think and get things done that upends and replaces a prior paradigm.

About 1000 years ago in China, there was a poem during the Song Dynasty (960 – 1279 AD) that begins with “In the Chang Jiang River, the waves behind drive on those ahead, so each new generation excels the last one”.

The popular phrase (pretty much the same meaning as “creative destruction”) continues today (and is widely quoted in China) that time makes it inevitable, in every profession, the rising generation is worthier than the former one.

The world has changed, and technologies will accelerate the change. The titans of the global corporate world are changing. It is creative destruction or paradigm shifts that necessitated the change? Would AI (including ChatGPT) be the next “paradigm shift”? Would you bet your career, your corporate survival, and family fortune that it will not?

There was an old debate on Wall Street, “Was it the bank that made the man, or the man who made the bank”, “Are you moving at 100 miles an hour, or is it the train that move at 100 milesan hour”? None of us can out-run the high-speed train. However, if we get on the train, we will arrive at our destination at 100 miles per hour.

The investing world is an easier journey. Getting on the right train (the right asset allocation) is of utmost importance. It may change your fortune and your life. The key to investment success is to recognize the changing dynamics, and adjust our investments accordingly.

Are you on the right train?