每周全球金融观察 | 第 142 篇:这是一个美好的世界; 这是一个充满机会的世界

来源:岭南论坛 时间:2023-06-12

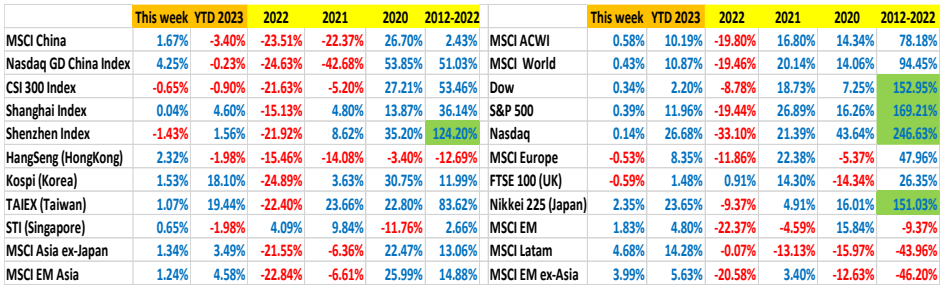

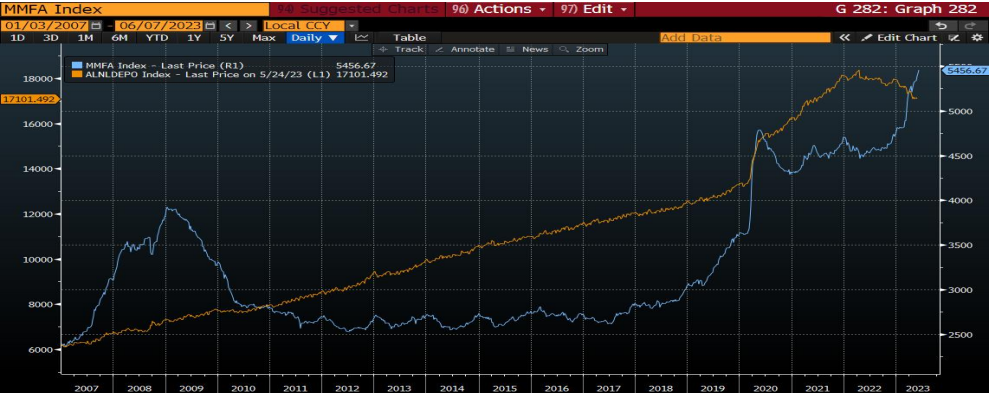

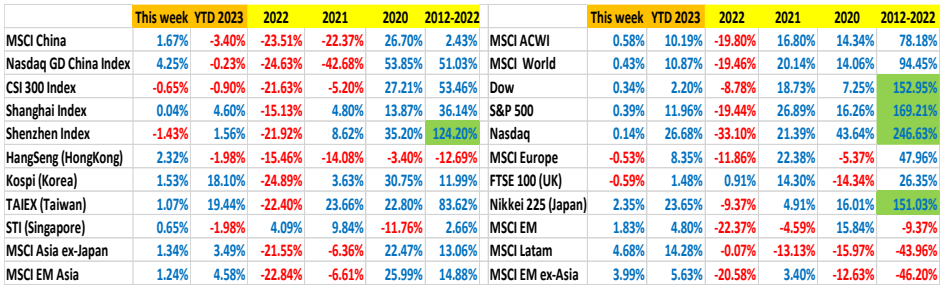

纳斯达克 100 指数(+32.8%),纳斯达克综合指数(+26.68%),日经 225 指数(+23.65%),标准普尔 500 指数(+11.96%),MSCI 欧洲(+8.35%),MSCI 中国(-3.4%):

S&P500 波动率(恐慌指数),利率波动率,货币(外汇)波动率:

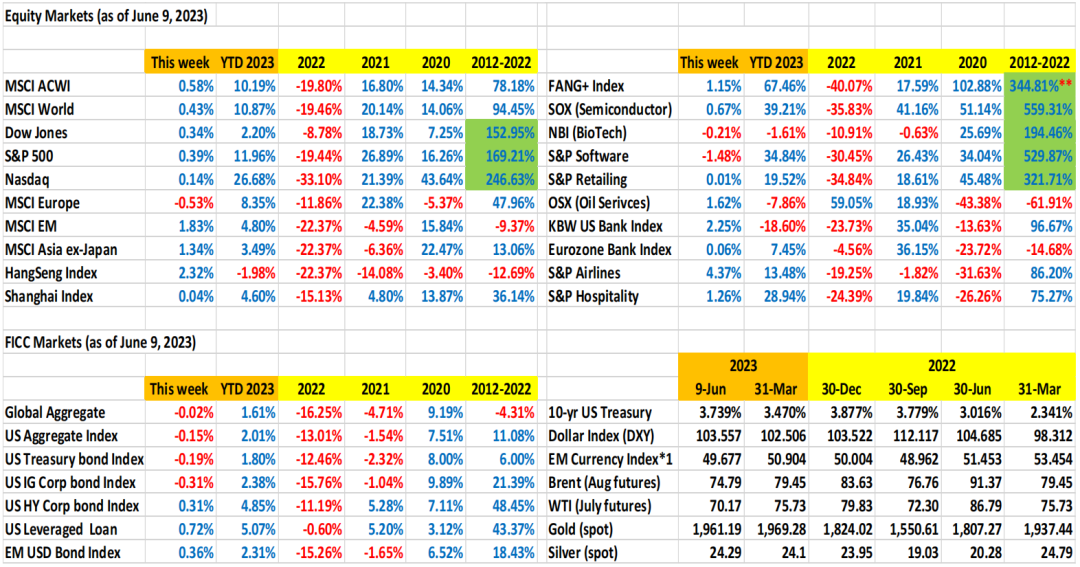

2023 年 YTD 的业绩与往年相比,请参考下表:

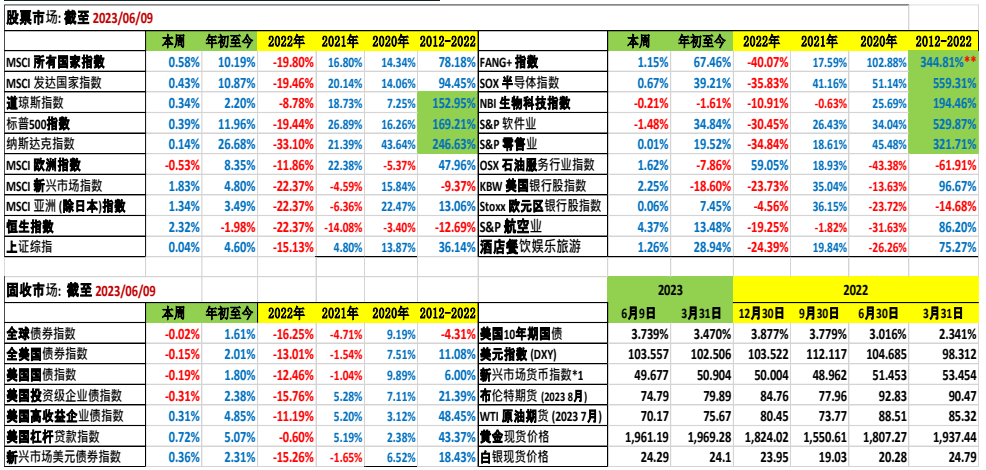

所有数据截至 6 月 9 日, *1 截至 6 月 8 日

我们将何去何从?

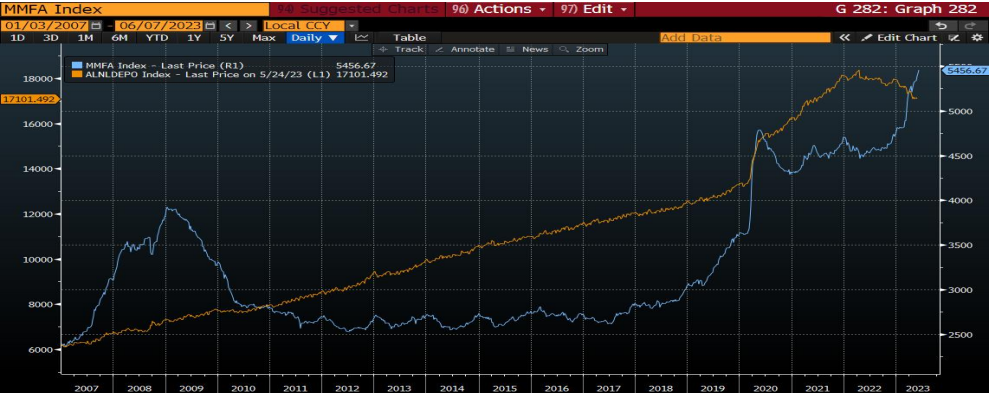

现金继续涌入美国货币市场基金:

美国货币市场基金资产(@6/7)和银行存款(@5/24):

指数化的谬误:

英伟达,苹果,微软,谷歌,亚马逊 vs 纳斯达克 100 指数,纳斯达克综合指数:今年以来的回报:

投资要有远见,不要用后视镜投资:

苹果公司的 Vision Pro:

作者:蔡清福

Alvin C. Chua

2023 年 6 月 11日, 星期日

东亚和中国股票市场的表现与全球同行的比较:

Article #142: It is a beautiful world; it is a world full of opportunities

With the much-feared US technical default and the potentially apocalyptic market disruption off the table (the US Congress worked out the debt-ceiling game of chicken before the X-date), the much-touted labor market capitulation again did not materialize for another month in May (May payroll gain of 339,000 vs 195,000 forecast, while the April payroll gain was revised from 253,000 to 294,000, vs an initial estimate of 185,000), together with the anticipation of Fed on a pause mode (the market is pricing-in a 70% probability of no rate hike on June 14, and possibly no more rate hike), the market is rightfully in a state of jubilation (or irrational exuberance).

The S&P500 hit an all-time high of 4,796 on Jan 3, 2022, and the 2022 low was 3,577 on Oct 12. On Thursday (June 8) the S&P500 closed at 4,293 (+11.84% YTD) which represents a 20.04% recovery from the Oct 12 low, officially ended the 248-day bear market (the longest since 1948).

In fact, YTD 2023 has been notable for out-performance in global equities, except for MSCI China.

Nasdaq 100 Index (+32.8%), Nasdaq Composite Index (+26.68%), Nikkei 225 Index (+23.65%), S&P500 (+11.96%), MSCI Europe (+8.35%), MSCI China (-3.4%):

After the 2022 debacle, market participants maintained a permanently bearish mindset going into 2023, with endless list of fears: the out-of-control inflation, the relentless rate hikes by the Fed and the ECB, the US debt default risk, the impending recession (always three months away), the banking crisis (always more banks to default), etc.

However, none of the apocalypses have materialized. Inflation (although still high vs policy makers’ target) but nevertheless receding, the end of rate hike cycle has arrived or approaching, US debt default averted (they always had been), the impending recession has been pushed back by series of 3-months and 3-months (yes, Eurozone is in technical recession, with -0.1% GDP 2growth in Q4 2022 and another -0.1% in Q1 2023, but is expected to grow 0.9% for 2023), and the labor market refusing to give-in, and the banking crisis contained.

Equity, interest rate, and currency volatilities have been on a declining path in 2023 (please see the following graph). Perhaps we could borrow the immortalized quote from FDR “the only thing we have to fear is fear itself.”

S&P500 Volatility (Fear Index), Interest Rate volatility, Currency (FX) Volatility:

Please refer to the following table for YTD 2023 performance vs prior years:

All data as of June 9, *1 as of June 8

Cash continues to pour into US Money Market Funds:

US money market fund AUM had sky-rocketed to $5.46 trillion by June 7 reporting week, up from $4.89 trillion (on March 8), an increase of $570 billion. On the other hand, the banking system deposits have declined from $17.66 trillion on March 1 to $17.1 trillion by May 24 reporting week, a decline of $560 billion. It is important to note that the increasing MMF AUM represents an enormous dry powder for risk assets.

US Money Market Fund assets (@6/7) and bank deposits (@5/24):

The fallacies of indexing:

Five stocks (Apple, Microsoft, Google, Amazon and Nvidia) account for 24% of S&P 500 market capitalization, and there are 495 other stocks. The same five stocks account for 54% of Nasdaq 100 index (NDX) and 43% of Nasdaq Composite Index (with 3,549 companies). We can dismiss the rally this year as being driven by a handful of stocks. However, in the world of indexing, ETFs, and passive investing, not investing in these five stocks would be disastrous, including the activemanagers. In fact, the more these stocks rally, the more passive as well as the active portfolios need to rebalance and increase their weighting. NEVER underestimate the power of indexing …

Nvidia, Amazon, Apple, Google, Microsoft vs Nasdaq 100 vs Nasdaq composite: YTD returns:

Investing with foresight, not with rear view mirror:

As the investing world was focusing on inflation, rate hikes, recession and US debt default apocalypse, a tremendous opportunity quietly passed us by. On May 24, Nvidia announced that sales for the next three months ending in July would be US$ 11 billion (more than 50% higher than Wall Street estimates) driven by a revival in data center spending by Big Techs and demand for the company’s H100 processors, the world’s first chip designed for “Generative AI”. On May 25, Nvidia stock rallied 24.37%, and gained US$184 market capitalization (3rd highest single day market cap gains, just slightly behind the 191 billion single day record set by Apple and Amazon). YTD Nvidia stock gained 165%. Nvidia is the 8th company to cross US$ 1 trillion market cap.

YTD June 9, 2023, the semiconductor sector gained 39.21%, the SOXX ETF gained 39.91%. The Nasdaq 100 gained 32.8%, while the Nasdaq gained 26.68%.

We are presently going through an AI (including ChatGPT) exuberance. However, AI will be nothing without Nvidia’s generative AI chips. It is fair to say, over the upcoming years (perhaps decades), the world will have insatiable demand for high end semiconductors to power all kinds of AI applications. This demand will not be affected by inflation, monetary policy and is likely to cross economic and political cycles.

Apple’s Vision Pro:

Apple launched its Vision Pro headset this week. At US$3,499, it seems extraordinary and beyond the spending limit of the masses. Apple justifies the Vision Pro’s hefty price by comparing it to the combined cost of a TV, sound system, computer, camera, and multiple displays, which it supposedly replaces. I am yet to be convinced. However, it will be years later before the final chapter is written, if the Vision Po is a flop and as wildly successful as the $499 iPhone we rejected in 2007.

On June 29, 2007, Apple launched the first iPhone. The consumer reception was not exactly exuberant, with only 12 million units sold in the first year (vs 200 million units last year). The earlier launch of iPod (in 2001) was anemic, and it took seven years for it to reach its peak of over 50m units a year. The Apple iWatch was considered a dud when it was launched, but it sold more than 50m last year, and in some years has outsold the entire Swiss watch industry.

I am an avid i-ecosystem person: iPod, iPhone, iMac, iPad, iWatch … My mistake, I didn’t own Apple stocks directly in my portfolio ….

Lesson #1: first generation flops can lead to 3rd of 4th generation hits.

20 years ago, most of us could live without a smart phone. Today, with mobile payments (Wechat Pay, AliPay, PayPal, etc), cab-hailing (Uber, Didi, …), and instance messaging (Wechat, corporate WeChat, WhatsApp), few of us can function normally without a smart phone (whether an iPhone, or Samsung phone, or Huawei phone). In fact, the handheld device has reached the tipping point well over a decade ago, without it one would be like living in the dark ages.

Lesson #2: don’t count the number of cars crossing the river via ferry when you build a tunnelunder the river (or a bridge). Btw, the ferry service stopped many years ago …

We need to remember lesson #2 in investing. The Nvidia H100 “generative AI” chip cost US$ 40,000 each, and it cost well over US$250 million of server hardware to build a “generative AI systems”.

25 years ago, the buzz word was “we need an internet strategy”. Sure enough, the internet has permeated to every aspect of our lives, and well as business. Today, every business will need an “AI strategy”. Who is not talking about AI and ChatGPT lately?

I popped my favorite question during several of my MBA lectures: “who do you think made the most money on Wall Street? The gun-slinging BSD trader who received US$100 million bonus? The hedge fund titan who earned a billion a year? The private equity titan who took home billions? Text me (I meant WeChat or WhatsApp, NOT the old mobile phone SMS please) if you know the answer or curious to know the answer.

East Asia and China equity markets performance vs the global peers: