每周全球金融观察 | 第139篇:期货市场已反映了利率下调

来源:岭南论坛 时间:2023-04-15

注:过去三个周末我都在出差,有两个星期没有写作。本周的文章晚了一天。我将在未来三个周末再次出差,并将努力继续写作(延迟)。

这是一个假期缩短的一周。自SVB暴雷(3月9日至12日)和瑞士信贷溃败(3月17日至19日)以来,市场一直保持得非常好。美联储(和FDIC)以及SNB(瑞士国家银行)的果断政策反应避免了银行业的系统性风险,尽管银行业的压力及其对更广泛经济的影响仍然存在。我们应该注意到,对银行和金融压力的政策反应是果断迅速、大胆和及时的;自2008年全球金融危机和2020年Covid-19的破坏性经历以来,执行效率不断提高。

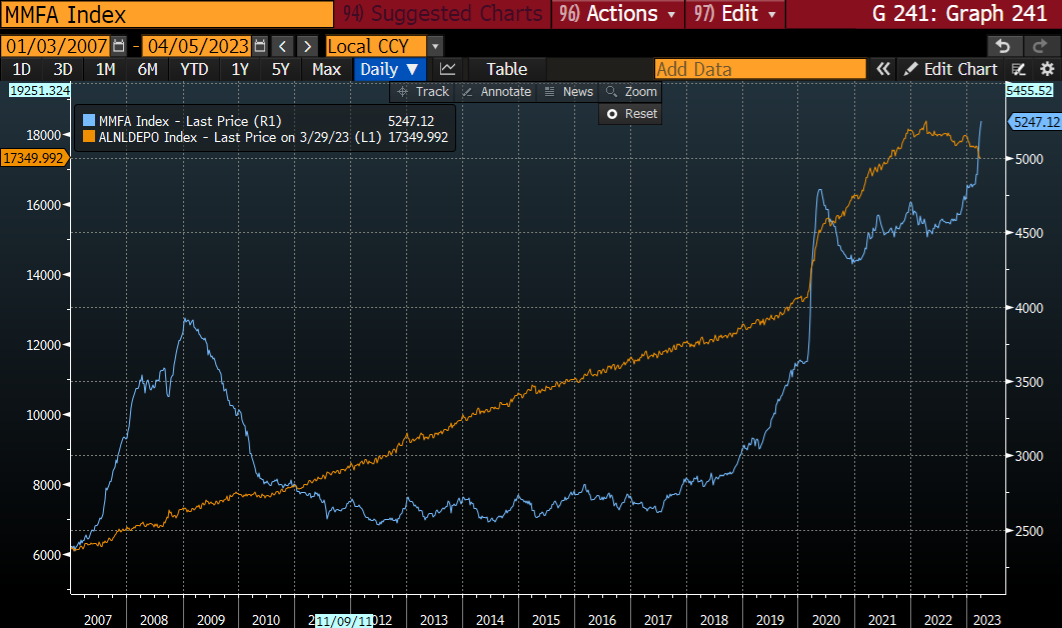

美国货币市场基金资产管理规模从4.89万亿美元(3月8日)飙升至4月5日的5.25万亿美元,增加了3600亿美元。另一方面,银行系统的存款已经从3月1日的17.66万亿美元下降到3月29日报告周的17.35万亿美元,下降了3100亿美元。

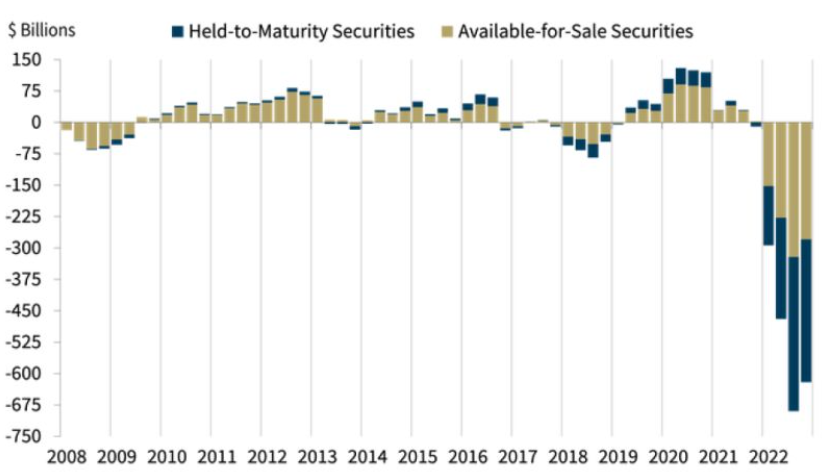

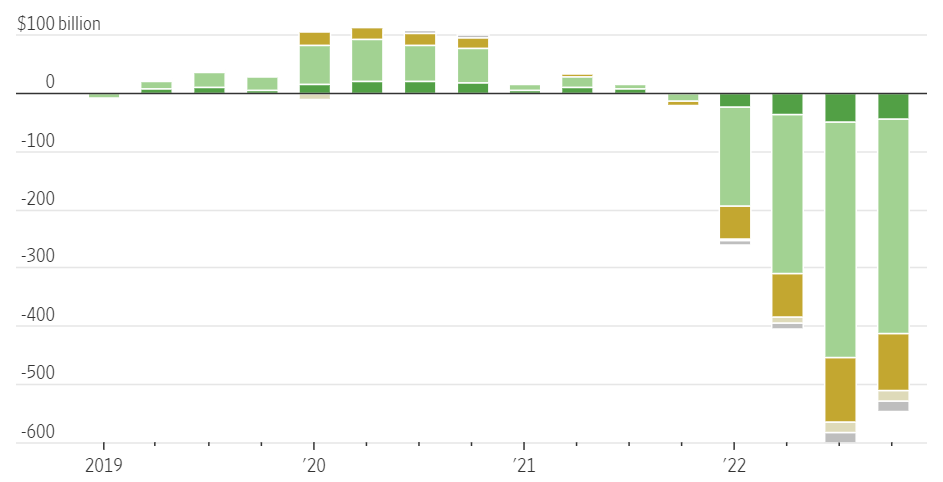

SVB的余波以及美国银行系统坐拥6200亿美元未实现的证券投资损失(截至2022年12月31日)的残酷现实,无疑将对银行的贷款意愿和能力产生负面影响,这将对GDP增长产生负面影响。

2年期美国国债收益率在3月8日(SVB的前一天)为5.073%,上周结束时为3.834%,下降了124个基点。市场正在为美联储降息和宽松的货币政策定价,这既是为了主动避免可能出现的信贷紧缩周期,也是为了让银行系统有时间来修复其资产负债表。

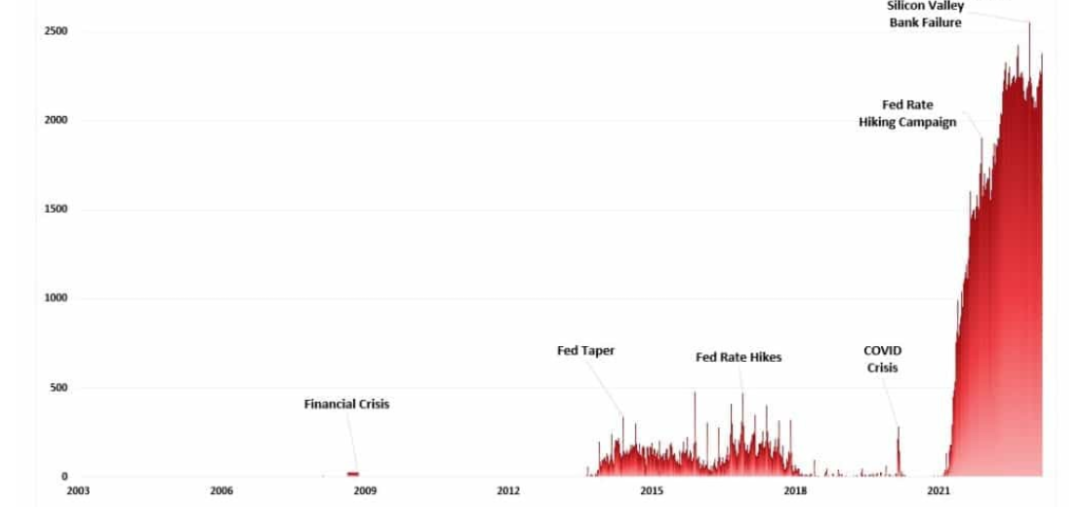

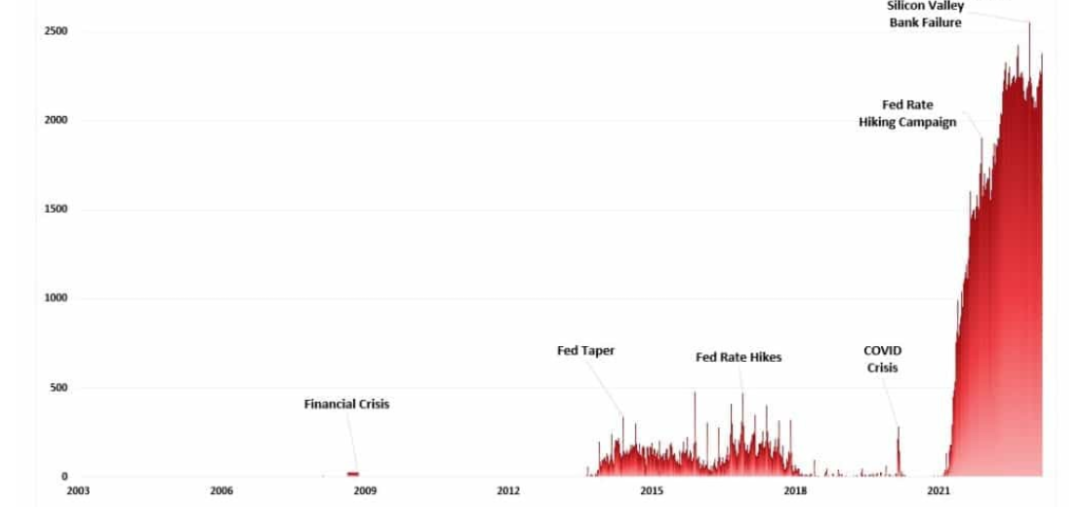

美联储的逆回购(卖出证券,吸收资金)在SVB溃败后达到2.5万亿美元,截至4月6日仍为2.173万亿美元。过多的逆回购是否表明:a)银行系统的流动性过剩,或者b)银行不愿意贷款(把钱停在美联储而不是贷款和投资)?

CME 30天联邦基金期货(截至4月6日)的定价是到2023年9月为4.665%(与目前的4.75-5.00%相比)。然而,期货市场对此后的一系列快速降息进行了定价:2023年12月(4.24%),2024年3月(3.88%),2024年6月(3.405%)。4月6日的2年期美国国债收益率为3.834%,而3月8日(SVB前一天)为5.073%。然而,CME 90天欧洲美元期货对2年期美国国债隐含收益率的定价为3.52%。

尽管自3月8日以来收益率曲线大幅下移,但美国的收益率曲线仍明显高于2022年年初的水平,而且是倒挂的。长时间的收益率曲线倒挂只会给银行系统带来更多的痛苦(HTM损失)。

市场在这个时候押注美联储(欧洲银行则押注欧洲央行)将通过降低短期利率(在短期存款利率和中期投资收益率之间创造正的利差,以及使收益率曲线正常化(向上倾斜)来间接救助银行,帮助银行减少6200亿美元的未实现损失。

我同意,我还要说:这将是股票和固定收益的一个巨大的利好。

The futures market has priced in interest rate cuts

Note: I was traveling the last three weekends, and skipped writing for 2 weeks. This week’s article is a day late. I will be traveling again in the next three weekends, and will endeavor to continue writing (with delay).

It was a holiday shortened week. The market has been holding up very well since the SVB implosion (March 9-12) and the Credit Suisse debacle (March 17-19). The decisive policy responses from the Fed (and FDIC) as well as the SNB (Swiss National Bank) averted a banking systemic risk, although the banking sector stress and its impact on the broader economy remain. We should note that policy responses to banking and financial stress have been decisively swift, bold, and timely; and with improving execution efficiency since the 2008 GFC and the 2020 Covid-19 disruption experiences.

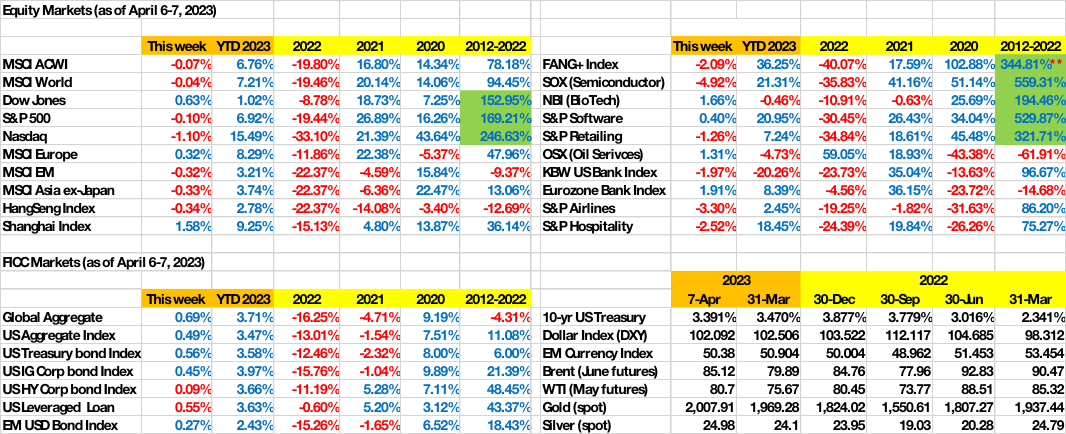

YTD, all the major equity and fixed income indices are solidly in the blue, with the market pricing-in upcoming policy easing tailwind vs the economic downturn headwind. So far, the tailwind has gained the advantage. The rate cut anticipation propelled the fixed income asset classes to a great Q1 return as well as this week.

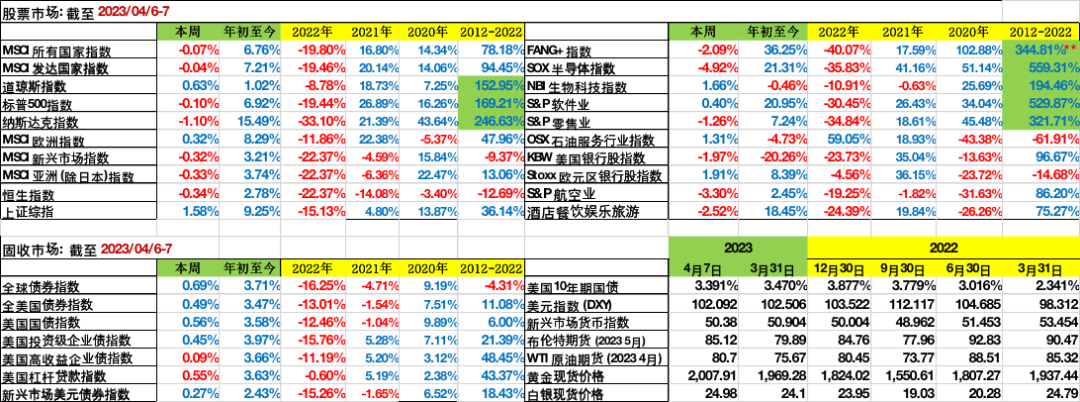

Please refer to the following table for YTD 2023 performance vs prior years:

All data as of April 6-7

Where do we go from here?

Cash continues to pour into US Money Market Funds:

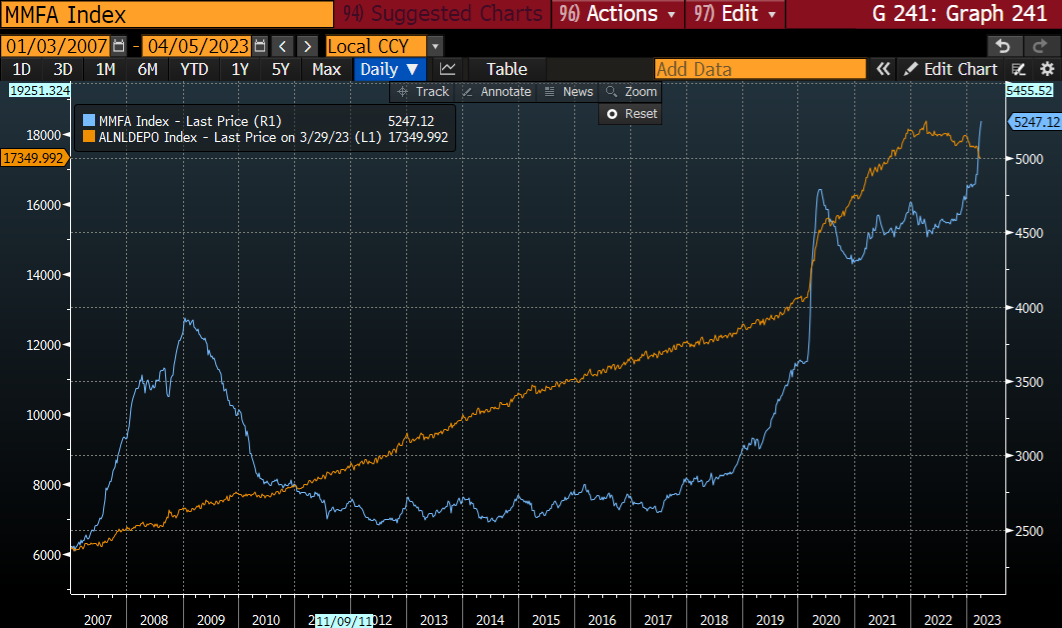

US money market fund AUM has sky-rocketed to $5.25 trillion by April 5, from $4.89 trillion (on March 8), an increase of $360 billion. On the other hand, the banking system deposits have declined from $17.66 trillion on March 1 to $17.35 trillion by March 29 reporting week, a decline of $310 billion.

US Money Market Fund assets (@4/5) and bankdeposits (@3/29):

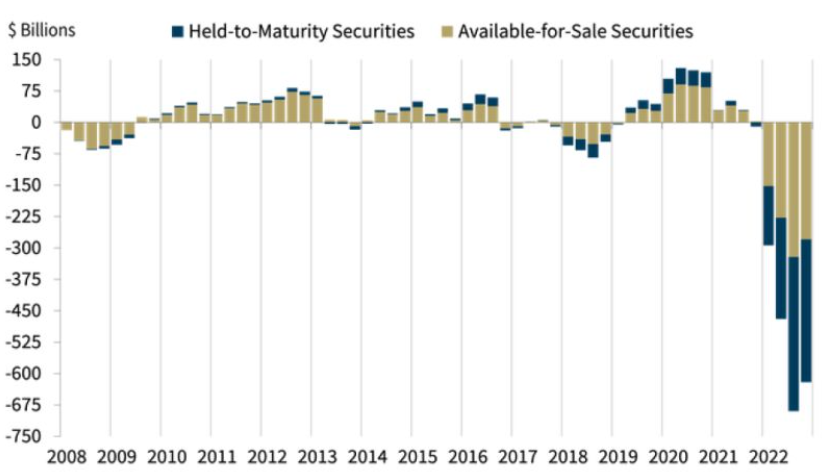

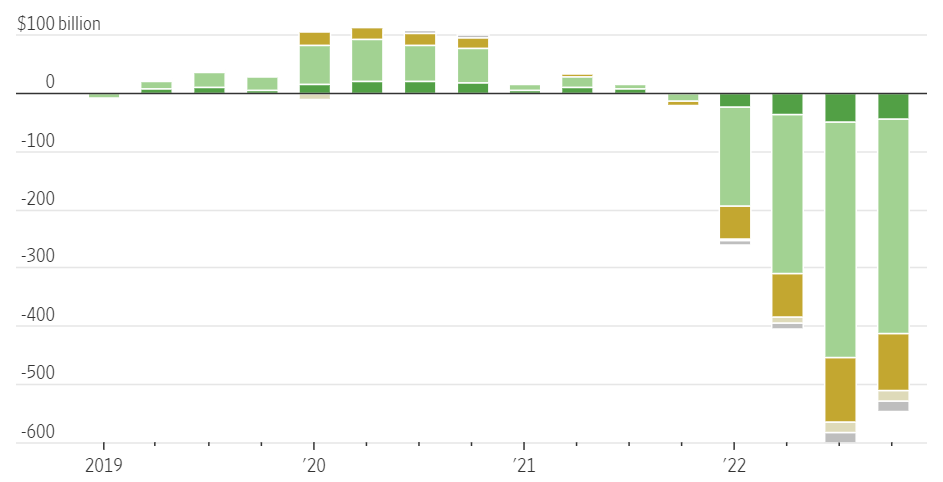

The fallout from SVB and the rude awakening that the US banking system is sitting on $620 billion of unrealized losses on security investments (as of 12/31/2022) will no doubt negatively impact bank’s willingness and ability to lend, which will negatively impact the GDP growth.

The 2-yr US Treasury yield was 5.073% on March 8 (the day before SVB) and ended last week at 3.834%, a 124bp decline. The market is pricing-in Fed rate cuts and accommodative monetary policy, both to pro-actively avert a possible credit tightening cycle, as well as to allow banking system time to repair its balance sheets.

Unrealized losses will handicap the banking system’s willingness and ability to lend:

US banks are sitting on $ 620 billion on unrealized losses from security investments:

MBS has been the culprit but be vigilant on CMBS:

The Federal ReserveReverse Repo has ballooned:

The Fed’s reverse repo (sell securities, absorb money) reached $2.5 trillion after the SVB debacle, and was still at $2.173 trillion as of April 6. Is the excessive reverse repo indicative of a) abundance of excess liquidity in the banking system, or b) banks are reluctant to lend (parking money at Fed instead of lending & investing)?

Interest Cut(s) are on the way:

The CME 30-day Fed Funds futures (as of April 6) is pricing in 4.665% by Sept 2023 (vs 4.75-5.00% presently). However, the futures market priced in rapid series of rate cuts thereafter: Dec 2023 (4.24%), March 2024 (3.88%), June 2024 (3.405%). The 2-yr US Treasury yield was 3.834% on April 6 vs 5.073% on March 8 (the day before SVB). However, the CME 90-day Eurodollar futures is pricing-in the 2-yr US Treasury implied yield at 3.52%.

Despite the dramatic yield curve down shift since March 8, the US yield curve is still significantly higher than the start of 2022, and inverted. A prolonged period of inverted yield curve will only add more pains to the banking system (HTM losses).

US yield curve: 1/2/2022 – 4/6/2023: Dramatic upward shift and inverted:

The market at this juncture is betting that the Fed (and the ECB for European banks) will indirectly bail out the banks by lowering short-term interest rates (creating a positive spread between short-term deposit rates and medium-term investment yields, as well as normalizing the yield curve (upward sloping) to help banks reduce the $620 billion of unrealized losses.

I agreed, and I shall add: it will be a tremendous tailwind for equities and fixed income.

By Alvin Chua

Sunday April 9

East Asia and China equity markets performance vs the global peers:

Data as of April 6-7