每周全球金融观察 | 第135篇:2022年的痛苦确实是2023年的收益;但2023年的错过将带来更多的痛苦

来源:岭南论坛 时间:2023-02-22

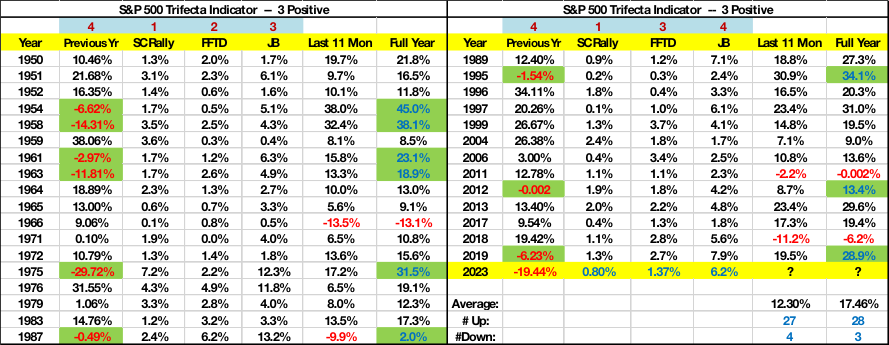

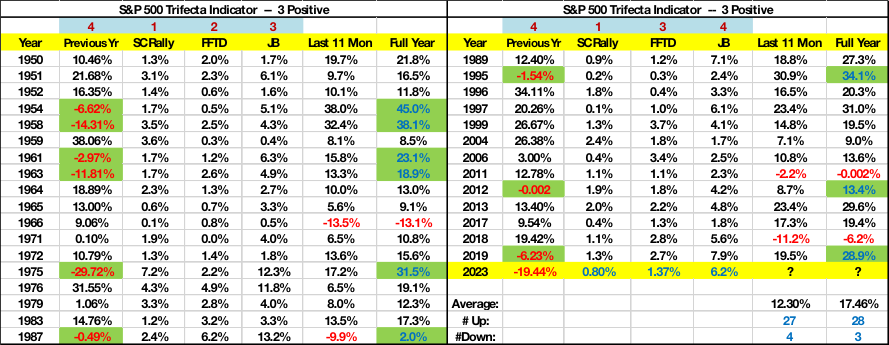

号外:我们有了2023年的 "三连胜指标"! 标准普尔500指数在1月份以6.18%的涨幅结束,正式宣告了2023年的 "三连胜指标"达成。

1月早些时候,我们的"圣诞老人反弹 "为0.80%(上一年最后5个交易日加上新一年前两个交易日的累计回报)。FFTD(前五个交易日)为+1.37%。自1950年至2022年(72年),"三连胜指标 "在31年内出现。在这31年中,标准普尔指数在28年中以正收益结束全年。

如果我们增加第四个维度。在有Trifecta指标的31年中,有9年标普500指数在上一年结束时出现亏损。在这9年中,标普500指数每年都以正数结束。 在2022年,标准普尔500指数为-19.44%。在2023年,"三连胜指标"得到满足。

正如预期的那样,美联储将联邦基金利率上调了25bp,至4.50%-4.75%的目标范围。然而,美联储并没有像加拿大银行那样"明确 "暂停。美联储主席鲍威尔承认通胀率下降,评论说 "通胀消退过程已经开始"(即:通胀步伐放缓),特别是关于商品价格的通胀放缓,商品价格占核心PCE价格指数(美联储首选的通胀指标,12月同比增长4.4%)的25%左右,并表示 "在我们确定达到足够的限制性立场所需的未来增长程度时,转向放缓步伐将使委员会能够更好地评估经济向我们的目标进展。" "我们将继续逐次作出决定,考虑到传入的全部数据及其对经济活动和通货膨胀前景的影响。" 截至周三,美联储可能已经完成了本周期的加息,但更愿意将这种可能性留到最后。在周五的就业报告之后,FOMC会很高兴地把它留到最后。

截至周五,CME期货定价在3月22日再次加息25bp的概率为99%,5月3日再次加息25bp的概率为63%。然而,期货市场对11月和12月的两次25bp降息进行了定价。

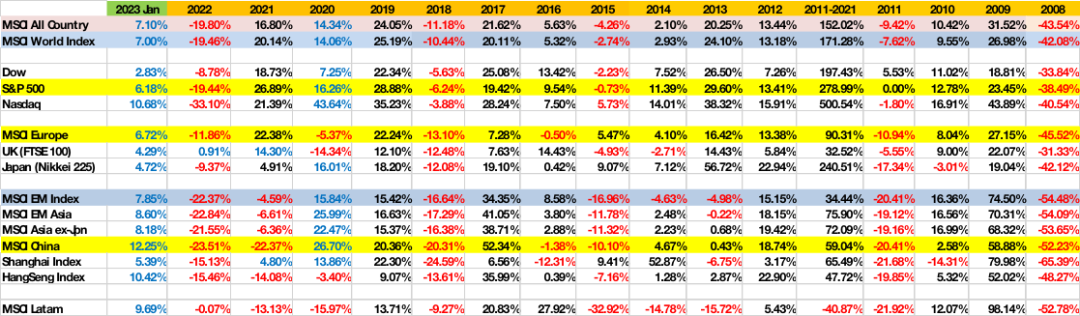

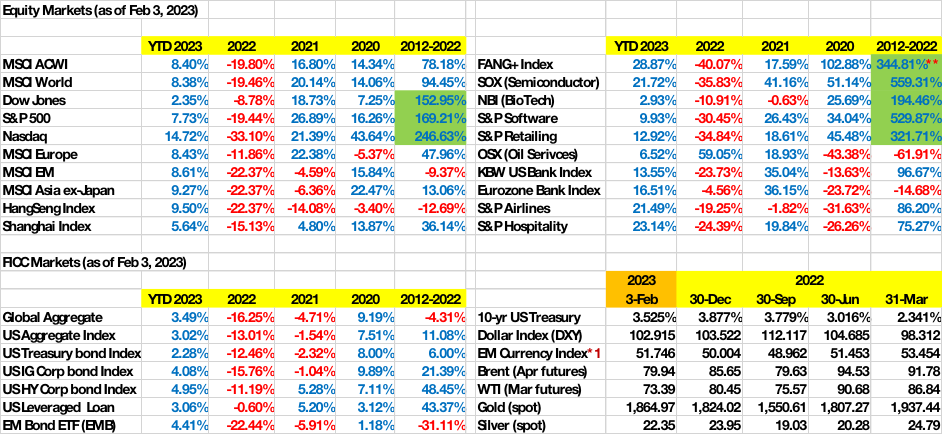

美国股市在FOMC新闻发布会后作出了积极的反应。三个指数都扭转了上午的跌势,以上涨收盘。市场预期已经果断地从加息转向加息的结束和利率的降低。道琼斯指数、标准普尔指数和纳斯达克指数YTD分别上涨2.35%、7.73%和14.72%。FANG+指数今年迄今涨幅高达28.87%。欧洲股市加入了牛市行情,MSCI欧洲指数和富时100指数分别上涨了8.43%和6.04%。2023年至今,新兴市场和亚洲股票仍然是表现突出的股票,MSCI新兴市场指数、MSCI亚洲(日本除外)指数、恒生指数和MSCI中国指数分别上涨了8.61%、9.27%、9.50%和12.02%。

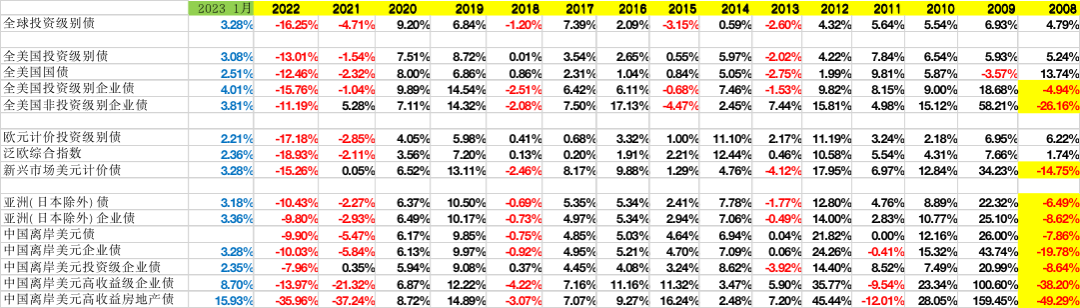

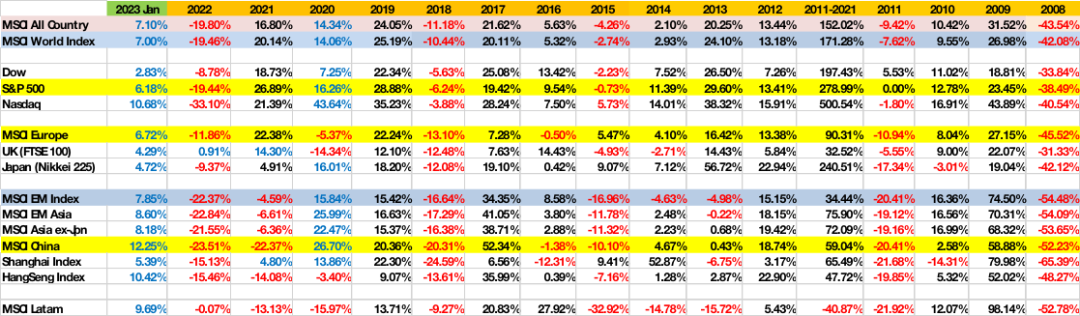

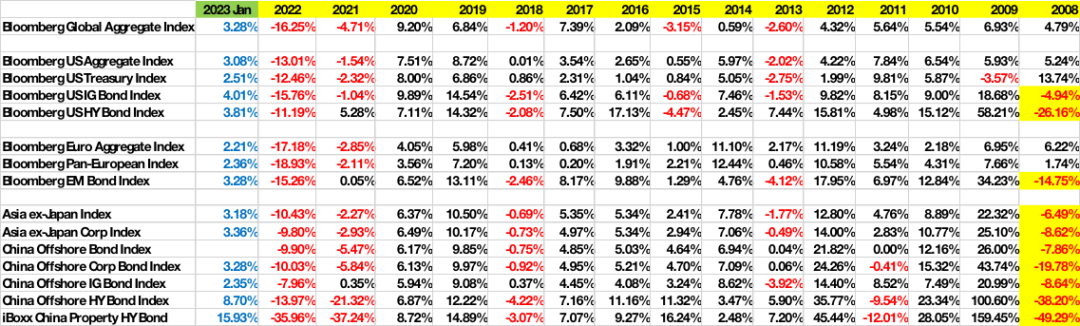

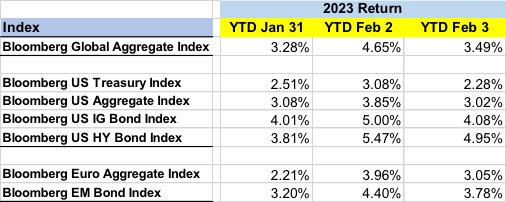

2023年至今与往年的比较请参考下表:

所有数据截至2月3日,*1:截至2月2日

我们该何去何从?

货币政策和利率

上周,加拿大银行是主要发达经济体中第一个宣布暂时停止加息的央行。

欧洲央行和英国央行周四都加息了50bp。欧洲央行行长克里斯蒂娜-拉加德在新闻发布会上更明确地表示,欧洲央行将在3月再加息50bp(预先宣布下一次加息!)。然而,她确实补充说,欧洲央行在3月加息后将取决于数据。

周三,美联储没有那么明确,从而为3月可能加息25bp打开了大门。然而,美联储主席鲍威尔确实使用了"取决于数据 "的说法。尽管如此,利息市场还是走在了曲线的前面。要么我们有一个软着陆(或硬着陆),美联储在2023年底前至少削减50bp,要么债券市场是错误的!!

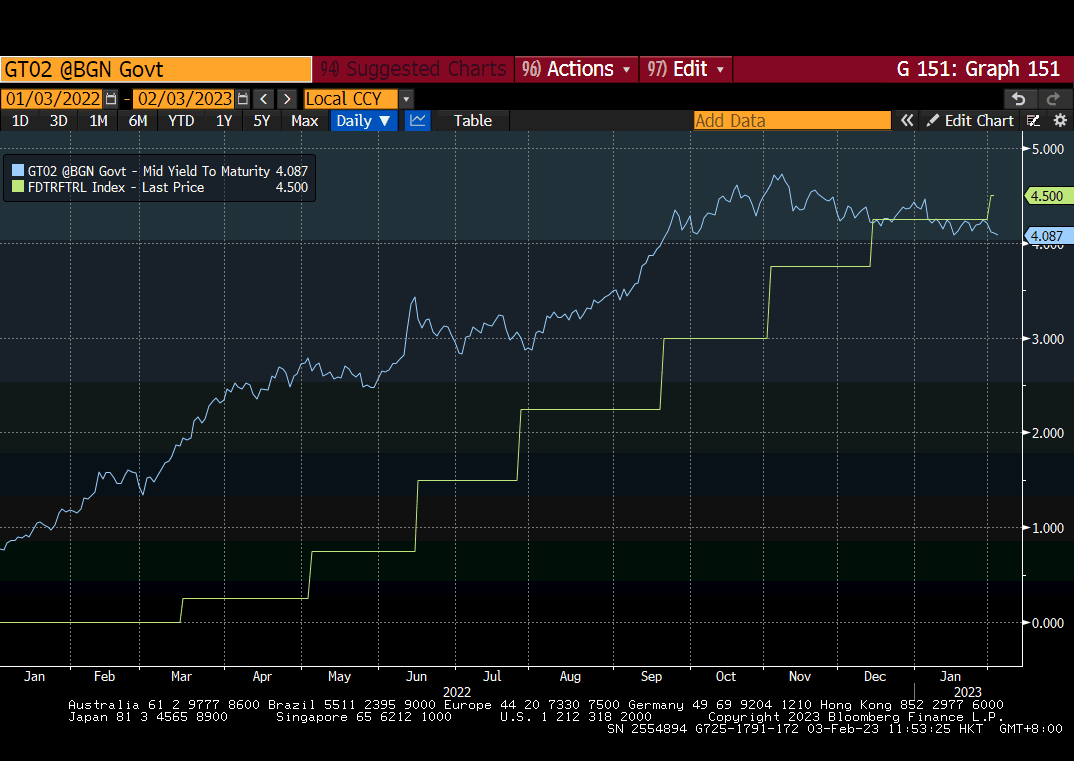

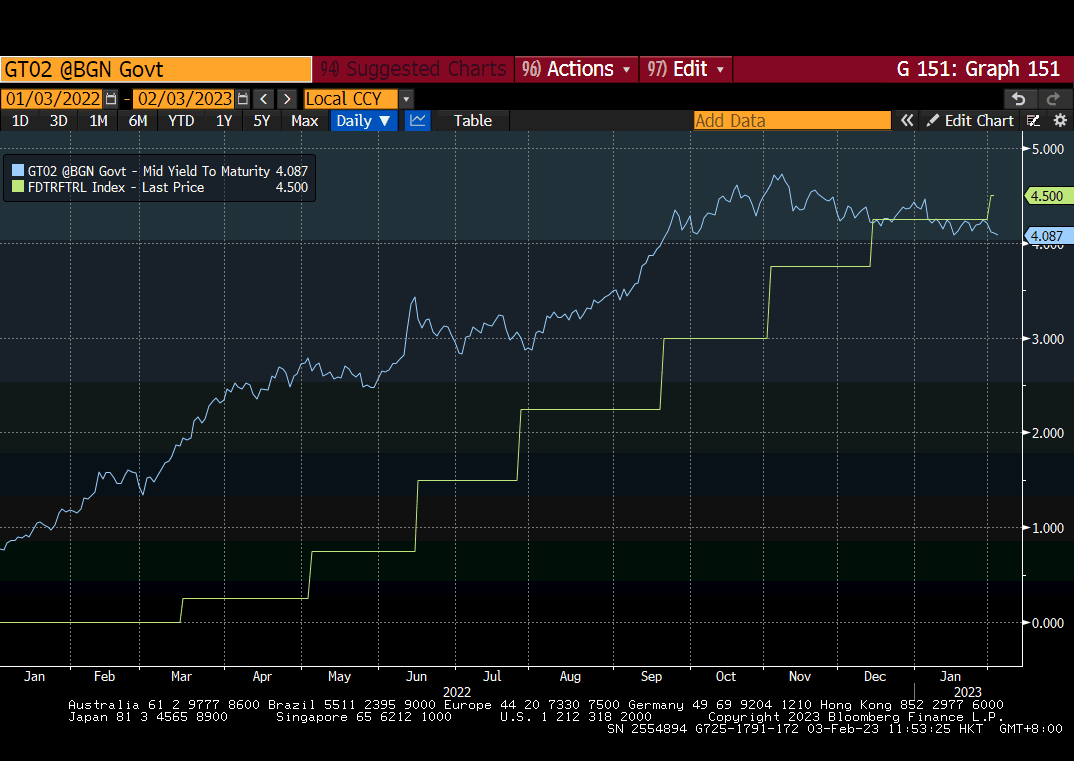

美联储基金利率和2年期美国国债收益率:

美联储隔夜基金利率目前为4.5%-4.75%,在美联储暂停之前可能会走向4.75%-5.00%(或5.00%-5.25%)。2年期美国国债收益率在2022年11月达到峰值4.72%,周四最低为4.08%(本周结束时为4.29%)。同时,美联储在此期间加息50bp+25bp,还有1-2次25bp加息的可能性。2年期国债在4.29%,美联储基金利率在4.75%,市场最好对今年年底/明年年初降息50bp或更多的定价是正确的,否则2年期美国国债将是一个令人尖叫的空头。同样,10年期美国国债在3.52,核心PCE平减指数在4.4%(美联储的目标是2%),我也不认为10年期美国国债处于有吸引力的水平。

全球股票市场

1月份对全球股票市场来说是一个伟大的月份,美国、欧洲、新兴市场和亚洲的股票都取得了坚实的YTD收益。事实上,纳斯达克综合指数1月表现按是2001年以来最好的。FOMO持续到2月份。

全球固定收益

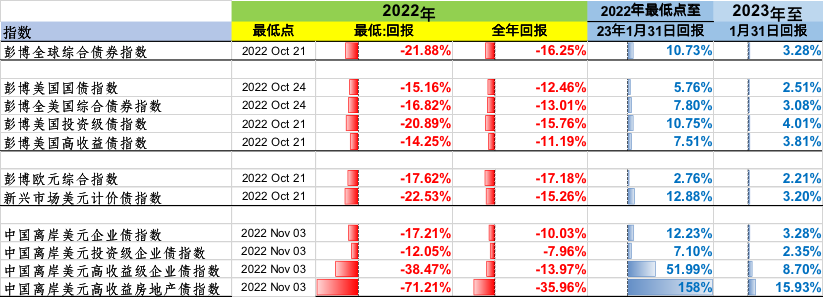

同样,全球固定收益市场度过了梦幻般的1月:

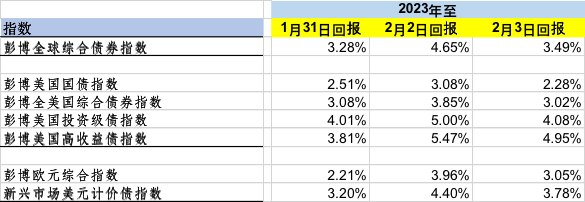

对于全球固定收益市场来说,这是个强劲的月份。彭博全球综合指数今年以来上涨了3.49%,而彭博美国综合指数则上涨了3.02%。今年以来,彭博美国IG债券指数和HY债券指数分别上涨了4.08%和4.95%。

我唯一担心的是:固定收益方面今年以来的超额表现,正在夺走相当多的2023年年化预期回报。

自2022年10月21/24日的低点到1月27日的回升最为引人注目。彭博全球综合指数自低点以来录得两位数(10.75%)的涨幅,彭博美国IG债券指数上涨10.50%。新兴市场债券自去年10月21日的低点以来上涨了13.03%。

全球固定收益市场:2022年的崩溃和随后的复苏

理性预期/非理性繁荣?

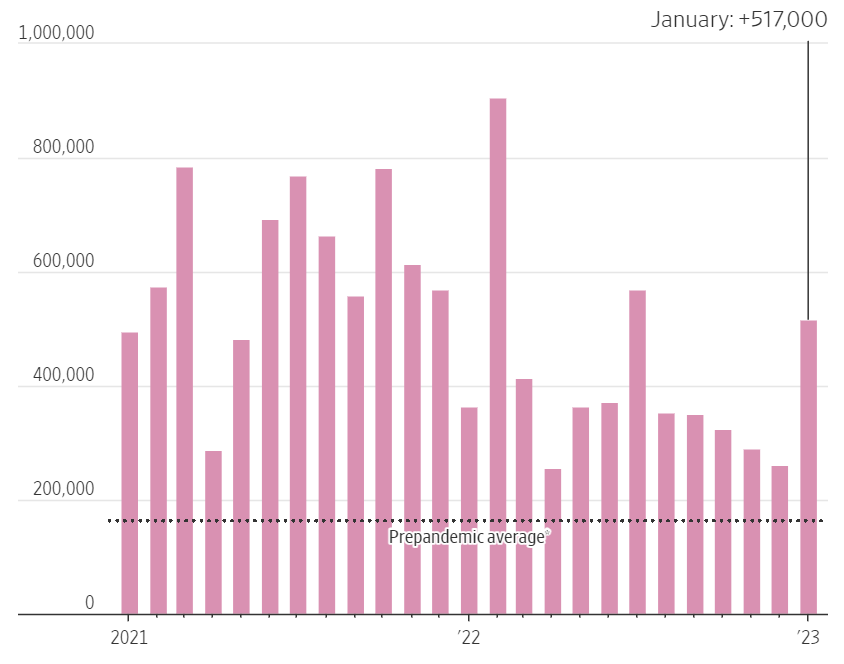

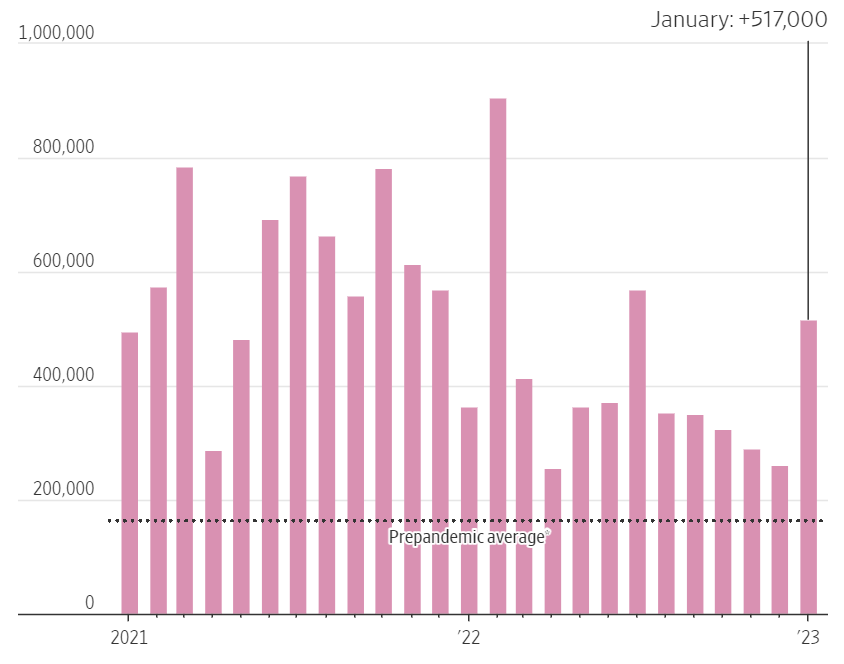

利率市场已经对今年晚些时候的"软着陆 "和降息的圣杯情景进行了定价。周五的就业报告对这种乐观的评估提出了质疑。2023年1月创造了51.7万个就业岗位(大大高于预测的18.5万个,而且11月和12月的数字都被修正得更高),失业率降至3.4%(53年多来的最低失业率),这种乐观情绪必须被重新评估。

美国非农就业人口月度变化:

经济继续创造就业机会,没有迹象表明它将放缓。就像PCE通胀率(12月为5%)和核心PCE平减指数4.4%(美联储首选指标)在过去几个月里一直在消退,但尽管如此,离美联储2%的目标还有相当大的距离。周五的就业报告改变了这一态势。美联储在3月份的FOMC会议上可能会也可能不会按下暂停键,联邦基金利率可能会高于4.75%-5.00%。周五,债券市场对乐观情绪重新定价是正确的。

我想强调的是,在上周五就业报告发布后,全球固定收益产品的重新定价,这在固定收益资产类别的背景下意义重大。

蔡清福

Alvin C. Chua

2023年2月4日,星期六

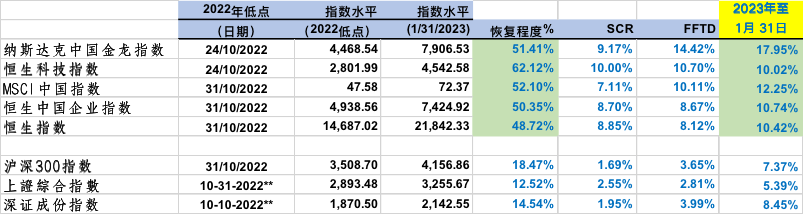

东亚和中国股票市场VS其他股票市场:

截至2023年2月3日的数据

The pain of 2022 is the gains of 2023. However, there will be more pain to miss the gains of 2023

It is official. We have the “Trifecta Indicator” for 2023! The S&P500finished the month of January with a 6.18% gain. The positive month of "January Barometer" completes the "Trifecta Indicator" for 2023.

Earlier in January, we had"SC Rally" of 0.80% (define as the cumulative return of the last 5 trading days of the prior year plus the first two trading days of the new year). The FFTD (first five trading days) was a positive 1.37%.

Since 1950 through 2022 (72 years) the "Trifecta Indicator" has occurred in 31 years. Out of the 31 years, the S&P had ended the full year positive in 28 out of 31 years.

If we add a 4th indicator. For the 31 years with Trifecta Indicator, there were nine years in which the S&P 500 ended the prior year with losses. In those 9 years, the S&P 500 ended every year in the positive.

In 2022, the S&P 500 was -19.44%. In 2023, the Trifecta Indicator" is met.

As expected, the Fed hiked the Federal Funds rate by 25bp, to a target range of 4.50%-4.75%. However, the Fed did not follow the Bank of Canada with an “explicit” pause. Fed Chairman Powell acknowledged the declining inflation with the comment that“the disinflation process has started” (ie: slowing pace of inflation), in particular about easing inflation in goods prices, which make up about 25% of the core PCE price index (the Fed’s preferred inflation gauge, which increased 4.4% YoY in December), with the statement “Shifting to a slower pace will allow the committee to better assess the economy's progress toward our goals as we determine the extent of future increases required to attain a sufficiently restrictive stance". "We will continue to make our decisions meeting by meeting, taking into account the totality of incoming data and their implications for the outlook for economic activity and inflation." As of Wednesday, the Fed may be done raising interest rates this cycle but prefers to leave the possibility open-ended. After Friday’s employment report, the FOMC would be pleased to have left it open-ended.

As of Friday, the CME futures was pricing in a 99% probability of another 25bp rate hike on March 22, and 63% probability of another 25bp rate hike on May 3. However, the futures market is pricing in two 25bp rate cuts in Nov and Dec.

The US equity markets reacted positively after the post-FOMC press conference. All three indices reversed the morning session losses to close the day with gains. The market’s modus operandi YTD has decisively turned from rate hikes to the end of rate hike and lower interest rates. The Dow, S&P and Nasdaq gained 2.35%, 7.73% and 14.72% respectively YTD. The FANG+ index gained an astounding 28.87% YTD. European equities joined the bull-run, with the MSCI Europe and FTSE 100 indices gaining 8.43% and 6.04% respectively. The EM and Asian equities continued to be the star performers so far in 2023, with the MSCI EM, MSCI Asia ex-Japan, HangSeng index, and MSCI China gaining 8.61%, 9.27%, 9.50% and 12.02% respectively.

Please refer to the following table for YTD 2023 performance vs prior years:

All data as of Feb 3, *1: as of Feb 2

Where do we go from here?

Monetary Policy and Interest Rates:

Last week, the Bank of Canada was the first central bank among major developed economies to declare that it is done raising interest rates for now.

The ECB and BoE both hiked by 50bp on Thursday. ECB President Christine Lagarde was more explicit at the press conference, stating that the ECB will hike another 50bp in March (pre-announcing the next rate hike!). However, she did add that ECB will be data dependent after the March hike.

On Wednesday, the Fed was not as explicit, and thus opening the door for a possible 25bp rate hike in March. However, Fed Chairman Powell did use the word “data dependent”. Nevertheless, the interest market is well-ahead of the curve. Either we have a soft-landing (or hard landing) and the Fed cut by at least 50bp by the end of 2023, or the bond market is WRONG!!

Fed Funds rate and 2-yr UST yield:

The overnight Fed funds rate is presently 4.5%-4.75%, and possibly heading to 4.75%-5.00% (or 5.00%-5.25%) before the Fed pauses. The 2-yr UST yield peaked in November 2022 at 4.72% and was as low as 4.08% on Thursday (ended this week at 4.29%). Meanwhile, the Fed has hiked 50bp and 25bp during this period, with possibility of 1-2 more 25bp hikes. With 2-yr treasury at 4.29% and Fed Funds rate at 4.75%, the market better be right for pricing in 50bp or more rate cut(s) by the end of this year/early next year, otherwise the 2-yr UST will be a screaming SHORT. Similarly, with the 10-yr UST at 3.52% and core PCE deflator at 4.4% (Fed’s target is 2%), I do not see 10-yr UST at attractive level either.

The Global Equity Market:

Themonth of January was a great month for the global equity markets, with solid YTD gains for US, European, EM and Asian equities. In fact, the Nasdaq composite index had the best January since 2001. The FOMOs continue into the month of February

Chinese Equity: Market lows in 2022 thru Jan 31, 2023 recovery:

Global Fixed Income:

Similarly, the global fixed income had a fantastic month of January (in the context of fixed income asset class):

It has been a strong month for the global fixed income markets. The Bloomberg Global Aggregate index gained 3.49% YTD, while the Bloomberg US Aggregate index gained 3.02% YTD. The Bloomberg US IG bond and HY bond indices gained 4.08% and 4.95% respectively YTD.

My only concern: the YTD outperformance in fixed income is taking away quite a bit of the annualized 2023 expected return.

The recovery since the Oct 21/24 lows in 2022 through Jan 31 has been most impressive. The Bloomberg Global Aggregate Index has registered a double-digit (10.73%) gain since the low, and the Bloomberg US IG bond index gained 10.70%. EM Bonds gained 12.88% since the low on October 21 last year.

Global Fixed Income markets: the 2022 debacle and subsequent recovery:

Rational Expectation or Irrational Exuberance?

The interest rate market has priced in a “soft landing” and rate cuts holy grail scenario later this year. The employment report on Friday cast doubts on the sanguine assessment. With 517,000 jobs created in January 2023 (significantly larger than the 185,000 forecast, and with both Nov and Dec numbers revised higher), and with unemployment rate fell to 3.4% (the lowest rate in more than 53 years), the holy grail scenario must be reassessed. Friday’s employment report effectively put an end to the debate about imminent recession in the US.

US non-farm payrolls, monthly change:

The economy continues to create jobs with no hint that it is about to slow down.As much as both the PCE inflation (at 5% in Dec) and the core PCE Deflator at 4.4% (the Fed preferred indicator) have been receding over the past several months, but nevertheless quite far away from the Fed’s target of 2%. Friday’s employment report changed the dynamics. The Fed may or may not hit the pause button at the FOMC meeting in March, and the Fed Funds rate may be higher than 4.75%-5.00%. The bond market on Friday was correct to re-price the exuberance.

I would like to highlight the following global fixed income repricing after the employment report on Friday, which was significant in the context of fixed income asset class.

By Alvin Chua

Saturday February 4

East Asia and China equity markets performance vs the global peers:

Data as of Feb 3, 2023