每周全球金融观察 | 第 133 篇: 2023年的收益纷至沓来

来源:岭南论坛 时间:2023-01-18

我将在下周六1月21日暂停周报,因为大中华区的许多投资者将过春节。第134篇将于1月28日(星期六)继续。我祝愿大家有一个快乐和健康的农历新年。愿兔年给我们带来好运(似乎如此)。

美国12月CPI符合预期,总体CPI连续第6个月放缓,同比为6.5%,11月为7.1%;核心CPI同比放缓至5.7%,11月为6.0%;环比通胀率为-0.1%。美联储官员可能会对同比通胀增速的下降趋势以及除食品、能源和住房外的CPI的疲软感到安慰。通胀下行趋势增加了美联储继续转鸽的可能性(从75bp到50bp到25bp到0bp),在2月和3月将隔夜利率提高0.25%,最终水平为4.75%-5.00%。

美国CPI增速(2022年6月达峰:9.1%):

个人消费支出平减指数(美联储的首选通胀指标):

美联储的首选通胀指标是个人消费支出平减指数。12月个人消费支出平减指数将于1月27日发布,市场预计5.1% (11月为5.5%),美联储的目标是2%。尽管通胀压力正在消退,但依然很难接近美联储的目标。也许3%才是新的目标?我们应预期隔夜利率在2023年剩余时间内保持在4.75%-5.00%。

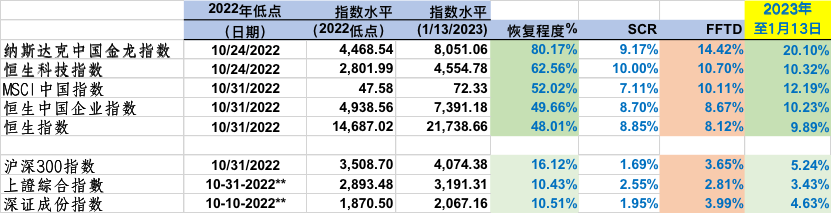

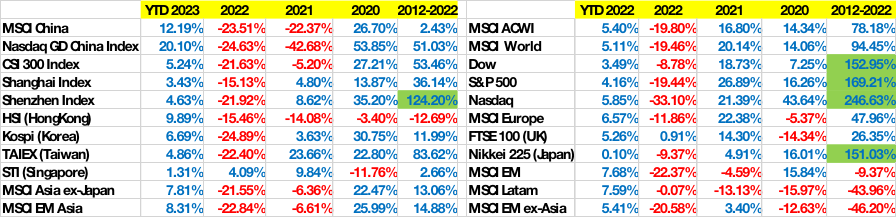

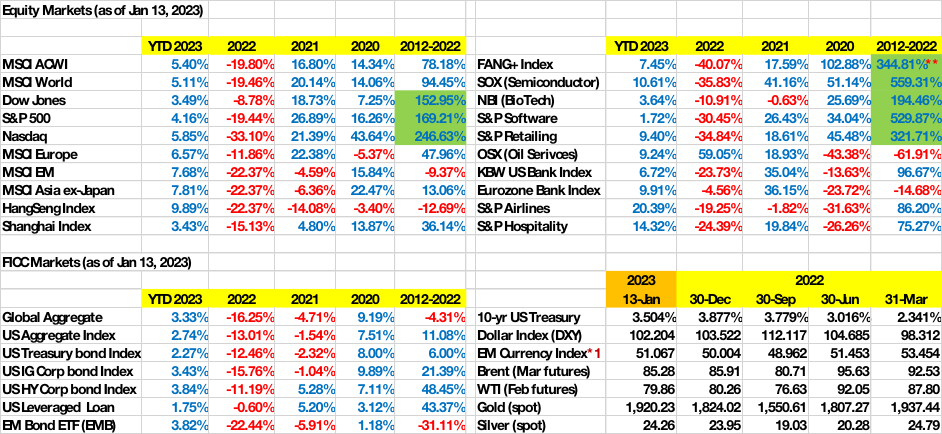

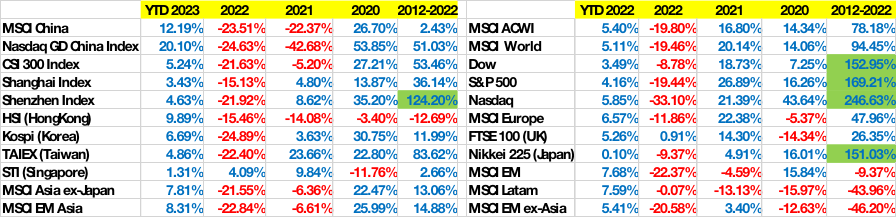

全球股票市场本周再传捷报。本周道琼斯指数、标准普尔指数和纳斯达克指数分别上涨2.00%、2.67%和4.82%。欧股继续上扬,MSCI欧洲指数和富时100指数分别上涨了1.75%和1.88%。 新兴市场和亚洲股票是本周的明星,MSCI新兴市场指数、MSCI亚洲(除日本)指数、恒生指数和MSCI中国指数分别上涨了4.16%、4.02%%、3.56%和4.27%。纳斯达克中国金龙指数(在美中概股)本周又上涨了5.72%,年初至今(9个交易日)的收益高达20.10%。

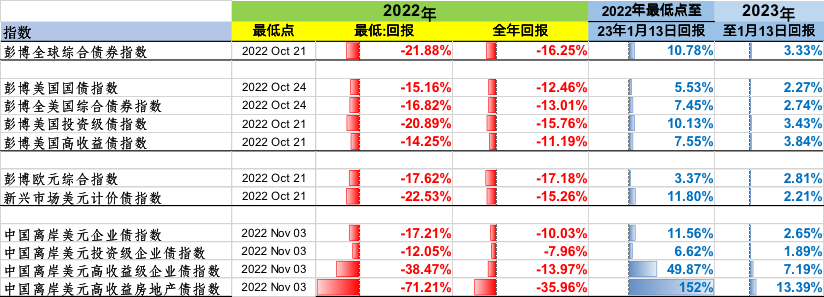

对于全球固定收益市场来说,这又是一个伟大的一周。彭博全球综合指数上涨1.91%,而彭博美国综合指数上涨0.88%。10年期美国国债收益率在本周结束时为3.50%。今年以来,彭博美国投资级债券和高收益级债券指数分别上涨3.43%和3.84%。

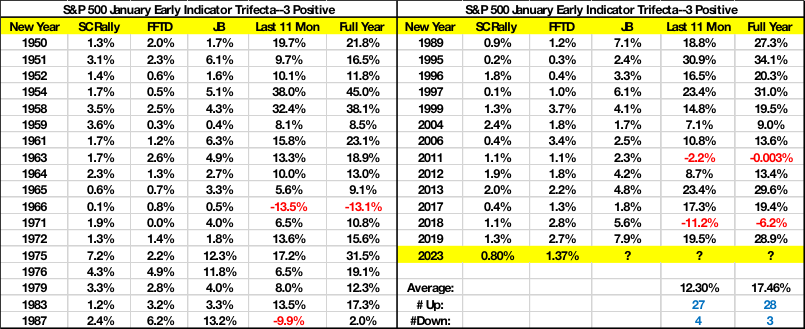

2023年第一周与往年的比较请参考下表:

所有数据截至1月13日,*1:截至1月12日

我们将何去何从?

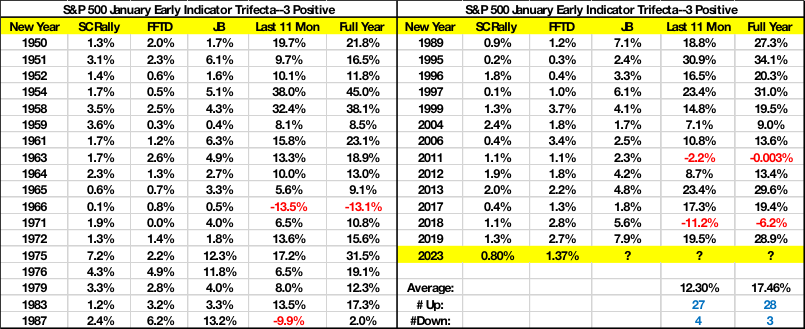

三连胜指标:“圣诞上涨”(SCR),“前五交易日”FFTD和1月晴雨表(Jan barometer):

“圣诞上涨”指标是由技术分析大师耶鲁赫希(Yale Hirsch)提出的,描述了在前一年最后5个交易日以及新年前2个交易日的市场表现。“前五交易日”指标则是指新一年前5个交易日的市场表现。“三连胜指标”的第三个指标,是“1月晴雨表”(“January barometer”),指的是1月份的整体市场表现。自1950年以来,SCR + FFTD + 1月晴雨表的“三连胜指标”均为正收益的完美组合一共出现了31次。这31年中,市场全年上涨的次数是28次。

2023年到目前为止,标普500指数同时满足了SCR和FFTD两连阳。我们需要等到1月31日才能知道我们是否拥有2023年的"三连胜指标"。

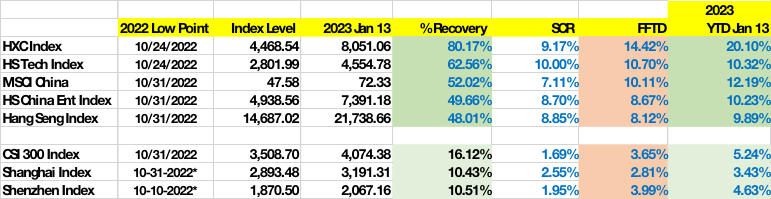

中国股票市场:2022年的痛苦就是2023年的收益

中国相关股票在2023年开始大放异彩。到目前为止,SCR和FFTD已实现两连阳。随着月初至今收益率的强势上涨,我们很可能看到三连阳。

2022年的市场低点到2023年1月13日的复苏:

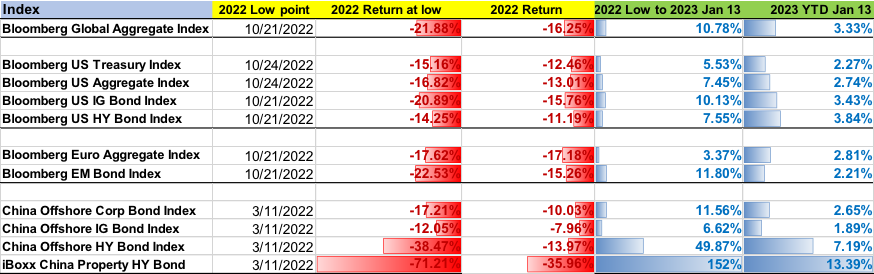

全球固定收益: 2022年的痛苦绝对是2023年的收益:

全球固定收益资产类别在2023年迎风启航。彭博全球综合指数在9个交易日内上涨了3.33%。我们几乎可以把9个交易日内2.74%(美国综合债指数)、3.43%%(美国投资级债指数)和3.84%(美国高收益债指数)的回报称为固定收益资产类别的"股票式 "回报。

自2022年10月21/24日的低点到1月13日的复苏最令人印象深刻。彭博全球综合指数自低点以来录得两位数(10.78%)的涨幅,彭博美国投资级债券指数上涨10.13%。中国房地产离岸高收益债指数的152%的收益可归因于灾难的严重性、指数的特异性以及政策的转折。

全球固定收益市场:2022年的崩溃和随后的复苏:

理性的期望或非理性的繁荣:

许多市场参与者被年初至今(以及自2022年10月的低点以来)市场反弹的速度和幅度打了个措手不及。对于基金经理(有月度、季度和年度同行排名)来说,错过年初至今的反弹将需要一整年的时间来痛苦地追赶。

回顾2022年10月,市场已经对最坏的情况(已知-未知)进行了定价,资产价格已经崩溃。宁愿选择第一类错误也不选择第二类错误,这是人类的天性(第一类错误是不致命的,因为损失是获利的机会。然而,第二类错误可能是致命的,因为它涉及到未能拒绝一个错误的假设,以及资本的损失)。市场有一种倾向,即只关注眼前,并将当下当作永恒,而大众媒体有一种更大的倾向,即加入短视者的行列并口口相传那些误导性的市场叙述。

重要的是要明白,市场不仅只有我们一小撮的特定类型市场参与者。全球数以百万计的市场参与者有不同的特点和局限性,从高净值投资者和财富管理机构,到超长期的主权财富基金,负债驱动的养老金和险资机构,相对回报的基金经理,绝对回报的对冲基金和特殊情况基金,到资产和负债驱动的银行投资组合,以及流动性和资本保全为首要任务的中央银行。

简而言之,每个参与者都在竞争,以不同的风格和方法,以及不同的风险容忍度、回报预期和时间跨度来获得回报。

我祝愿大家有一个快乐和健康的农历新年。愿兔年为我们带来好运。

蔡清福Alvin C. Chua

2023年1月14日,星期六

东亚和中国股票市场的表现vs全球其他市场:

数据截至2023年1月13日

The gains of 2023: We received thesecond installment this week

I will skip this weekly article next Saturday Jan 21, as many investors in the Greater China region will be away for the Chinese New Year holiday. Article #134 will resume on Sat Jan 28. I wish everyone a happy and healthy lunar new year. May the year of the Rabbit bring us good fortune (seems likely).

The December US CPI report came in close to expectations with the headline CPI slowing for the 6th consecutive month at 6.5% YoY vs 7.1% in Nov. The core CPI slowed to 5.7% YoY vs 6.0% in Nov. MoM, the headline inflation was -0.1%. Fed officials will likely take comfort in the downward trend in YoY inflation as well as softness in the CPI ex-food & energy, and shelter. The inflation trend increases the likelihood that the Fed will continue with the policy pivot (from 75bp to 50bp to 25bp to 0bp), with an increase of 0.25% in the overnight interest rate in Feb and March, and the terminal level at 4.75% to 5.00%.

US CPI inflation: the 2022 peakedinflation reached 9.1% in June 2022:

PCE deflator, the Fed’s preferred inflation indicator:

The Fed’s preferred inflation indicator is the PCE deflator. The Dec PCE deflator data is scheduled for release on Jan 27, with a market estimate of 5.1% (it was 5.5% in Nov). The Fed’s PCE target is 2%. Even though the inflation pressure is receding, the PCE inflation is no way near the Fed’s 2% target. Perhaps 3% is the new 2%? We should expect the overnight interest rate to remain at 4.75% - 5.00% area for the remainder of 2023.

Global equity markets had another good run this week. The Dow, S&P and Nasdaq gained 2.00%, 2.67% and 4.82% respectively this week. European equities have a second week of gains, with the MSCI Europe and FTSE 100 indices gaining 1.75% and 1.88% respectively. The EM and Asian equities were the star performers this week, with the MSCI EM, MSCI Asia ex-Japan, HangSeng index, and MSCI China gaining 4.16%, 4.02%, 3.56% and 4.27% respectively. The HXC index (Chinese equities listed in the US) gained another 5.72% this week, and a whopping 20.10% gain YTD (9 trading sessions).

It was another strong week for the global fixed income markets. The Bloomberg Global Aggregate index gained 1.91%, while the Bloomberg US Aggregate index gained 0.88%. The 10-yr US Treasury bond yield ended the week at 3.50%. YTD, the Bloomberg US IG bond and HY bond indices gained 3.43% and 3.84% respectively.

Please refer to the following table for first week 2023 vs prior year comparisons:

All data as of Jan 13, *1: as of Jan 12

Where do we go from here?

The Trifecta Indicator: SCR, FFTD and January barometer:

The Santa Claus Rally (SCR) indicator was devised by the legendary market technician Yale Hirsch as the last 5 trading days plus the first 2 trading days of the new-year. FFTD is a straight-forward term referring to the first 5 trading days of the year. The 3rd indicator “January barometer” is simply the performance in the month of January. Since 1950, a perfect combination of positive SCR + FFTD + January barometer “Trifecta Indicator” has occurred 31 times, and the market has been up 28 out of those 31 years.

So far in 2023, the S&P 500 index has met both the SCR and FFTD. We will need to wait until Jan 31 to tell if we have the “Trifecta Indicator” for 2023.

China Equity Markets: the pain of 2022 is the gains of 2023:

China related equities started 2023 with a big bang. So far, the SCR and FFTD have been met. With strong gainsMTD, we are likely to see the Trifecta indicator.

China Equities: from 2022 low point to Jan 13, 2023:

Global Fixed Income – the pain of 2022 is the gains of 2023:

The global fixed income asset classes had a tremendous start in 2023. The Bloomberg Global Aggregate Index gained 3.33% in 9 trading sessions. We can almost call the 2.74% (US Aggregate), 3.43% (US IG), and 3.84% (US HY) returns in 9 trading days as “equity-liked” returns in the fixed income asset class.

The recovery since the Oct 21/24 lows in 2022 through Jan 13 has been most impressive. The Bloomberg Global Aggregate Index has registered a double-digit (10.78%) gain since the low, and the Bloomberg US IG bond index gained 10.13%. The 152% gain in the China property offshore HY bond index can be attributed to the severity of debacle, index idiosyncrasy, as well as policy pivots.

Global Fixed Income markets: the 2022 debacle and subsequent recovery:

Rational Expectation or Irrational Exuberance:

Many market participants were caught off-guard by the speed and magnitude of the market rallies YTD (as well as since the October 2022 lows). For fund managers (with monthly, quarterly, and annual peer-group rankings) missing the YTD rally will be a painful year of playing catch-up.

Looking back at October 2022, the market had priced in the worst (the known-unknowns) and asset prices had broken-down. It is human nature to prefer a Type I error to a Type II error (Type I error is non-fatal as the loss is the opportunity to profit. A Type II error, however, could be fatal, as it involves the failure to reject a false hypothesis, and a loss of capital). There is a tendency for markets to focus on the present and extrapolate it forever, and there is a greater tendency for the popular media to jump on the bandwagon and regurgitate the seductive narratives.

It is important to understand that the market is beyond just us -- a single group of market participants. The millions of market participants across the globe have different characteristics and limitations, from HNW investors and wealth managers, to the ultra-long-term sovereign wealth funds, the liability-driven pensions and insurance, the relative return fund managers, the absolute return hedge funds and special situation funds, the asset and liability driven bank portfolios, as well as the capital preservation and liquidity conscious central banks.

In short, everyone is competing to earn a return, with diverse styles and approaches, as well as with different risk tolerances, return expectations, and time horizons.

I wish everyone a happy and healthy lunar New Year. May the year of the Rabbit bring us good fortune.

By Alvin Chua

Saturday January 14, 2023

East Asia and China equity markets performance vs the global peers:

Data as of Jan 13, 2023