每周全球金融观察 | 第 148 篇:FOMOs 转向拥抱风险资产

来源:岭南论坛 时间:2023-07-24

FOMO = 害怕错过。事实上,这两周很多 FOMO 都不情愿地转为了多头,投降的 RISK-ON、ALL-IN ....

过去两周,道指已连续 10 个交易日上涨(周五勉强上涨 2.5 点,涨幅为 0.01%),这是自2017 年 8 月以来的最长连涨期。标准普尔指数和纳斯达克指数在过去 10 个交易日中分别上涨了 8 个和 7 个交易日。许多狂热坚定的空头正在舔舐伤口,许多人不情愿地勉强转为多头。特斯拉和 Netflix "乏善可陈 "的第二季度财报以及纳斯达克 100 指数即将出现的周期外再平衡,使得纳斯达克综合指数周四下跌 2.05%,但道指上涨 0.47%。道琼斯工业平均指数(Dow Jones Industrial Average)周四创下 52 周新高。从一开始几乎完全由少数科技股(华丽的 7 大科技股)推动的反弹,到衰退担忧消退推动的跨行业大涨。

本周四,道琼斯运输指数(TRAN)也创下了 52 周以来的新高。从历史上看,运输指数是经济形势走强的先行指标。工业指数和运输指数双双创下 52 周新高,被视为牛市完好无损并有望进一步走高的信号。

我记得一位资深技术分析师曾经说过,在道氏运输平均指数(TRAN)加入牛市之前,牛市都不算牛市。期待已久的道氏理论 Dow Theory 牛市信号终于在本周到来。这是因为道琼斯工业平均指数和道琼斯运输平均指数都突破了之前的反弹高峰。虽然突破确认了新生的上升趋势,但人们可能会质疑平均指数作为现代经济中代表性基准的相关性。

我还想补充一点:至少,道琼斯运输平均指数的突破是对经济健康状况的肯定。

纳斯达克、道琼斯运输、标准普尔、道琼指数:2022 年 10 月 12 日以来的涨幅百分比

CME 期货定价显示,7 月 26 日加息 25 个基点的概率为 99.5%,普遍预计这是最后一次加息。欧洲央行预计在 7 月 27 日将基准利率上调至 3.75%(2001 年以来的最高利率,也是欧元诞生以来的最高利率)。

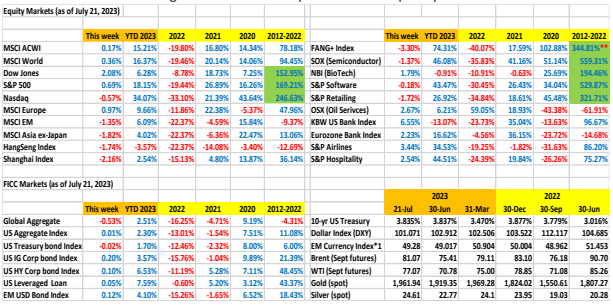

请参阅下表,了解 2023 财年与往年的业绩对比:

所有数据截至 7 月 21 日,*1 截至 7 月 20 日

我们将何去何从?

CBOE VIX 指数(又称恐惧指数)最近创下了自 2020 年 1 月(即 Covid-19 大流行的前一个月)以来的最低水平。有些人认为,既然 "波动"(波动率)如此之低,就只有下行风险(即 "波动 "飙升,市场修正/崩溃)。我们需要记住,"波动率 "不会无缘无故飙升。波动率 "的大幅飙升必然是由于外生事件(预测下一次大流行病或核战争)引发的市场失调,而我们在投资中无法将这些因素考虑在内。

那么,VIX 指数长期保持低位的情况又如何呢?追溯到 VIX 指数诞生之初(1990 年),长期低 "波动率"(低于 14)总是与长期牛市相吻合。你敢打赌这次会有所不同吗?

事实上,股票、货币和利率的低 "波动 "环境是风险资产的利好因素

美国银行第二季度净收入增长 19%,达到 74.1 亿美元,而 2022 年第二季度为 62.5 亿美元。收入增长 11%,达到 252 亿美元。美国银行凭借主街和华尔街业务的独特组合,取得了卓越的第二季度业绩。

"Erica "是美国银行自主研发的虚拟助理,它能帮助消费者银行客户高效互动地完成汇款、获取账户信息、在线支付等任务。目前,这种个性化、互动式的主动洞察力已占到与客户互动的 60%。据美国银行称,2023 年上半年,客户与 Erica 的互动次数超过 3.33 亿次。

除了 "Erica",美国银行还依靠数字平台提高成本效益。第二季度,数字家庭占银行关系的83%。该银行目前拥有 4600 万活跃的消费者用户客户,每月与银行数字平台的数字互动次数超过 10 亿次。

对于一家经营全国性分行网络的银行来说,成本效益意味着利润底线,而技术则有助于实现无缝运营。美国银行已将分行数量从一年前的 3984 家减少到第二季度末的 3887 家(五年前为 4341 家),同时在过去 12 个月中增加了 15.7 万名消费者客户。

对于那些仍然怀疑数字工具和人工智能会夺走工作机会的人,请再想一想。

美国银行消费者银行数字平台:

资料来源:美国银行 2023 年第二季度财务业绩报告:美国银行 2023 年第二季度财务业绩简报

微软股价在过去 10 年中上涨了 1000%(股息再投资为 1225%)。10 年前,投资界认为微软是一家成熟的科技公司,最好的时代已经过去。错了!除了 Windows 操作系统,公司还在不断创新。云计算取得了巨大成功。Azure 将计算从云端带到了边缘 edge computing,尤其是当每个应用都由人工智能驱动时。即将斥资 750 亿美元收购的动视暴雪公司(Activision Blizzard)将把公司扩展到互动娱乐领域(和元宇宙!)。最新的转型是人工智能。今年 1 月,微软向人工智能聊天机器人 ChatGPT 的母公司 OpenAI 投资 100 亿美元,大举进军人工智能领域。

微软价格:2013-2023 年:涨幅 1000

周二,微软股价创下历史新高,因为这家科技巨头公布了微软 365 新人工智能订阅服务Copilot 的更高价格(每月 30 美元)。目前,微软股价在今年已经上涨了 50%,反映了投资者对微软投资 ChatGPT 制造商 Open AI 的看好。Copilot 是一款生成式人工智能助手,旨在补充微软的办公程序套件,据说可以总结用户的未读邮件、重新格式化 PowerPoint、根据需求编写大纲草稿等等。

我们可以预料,Copilot 将带走大量 "办公室"(行政、文秘、分析相关)工作。

世界已经变化, 并将继续以指数级的速度发生变化。

作者:蔡清福

Alvin C. Chua

2023 年 7 月 23日, 星期日

东亚和中国股票市场的表现与全球同行的比较:

Article #148:FOMOs Turned Risk On

FOMO = Fear Of Missing Out. In fact, a lot of FOMOs have reluctantly turned bulls these two weeks, with capitulating RISK-ON, ALL-IN ….

The Dow has rallied for 10 consecutive sessions these past two weeks(eked out a 2.5 point, 0.01% gain on Friday) the longer streak since August 2017. The S&P and Nasdaq gained in 8 and 7 out of the past 10 session. Many fanatically determined bears are licking their wounds, and many begrudgingly throw in the towel, and reluctantly turned bull. 2023 is the year whereby a super majority of big-name Wall Street strategists and economists got it very wrong.

The Tesla and Netflix “lack-of-awe” Q2 results and the upcoming out-of-cycle rebalancing in the Nasdaq 100 sent the Nasdaq composite index 2.05% lower on Thursday, but the Dow gained 0.47%. The Dow (Dow Jones Industrial Average) made a 52-week high on Thursday. What started as a rally driven almost entirely by a handful of tech stocks (the magnificent 7) has morphed into a cross-sector surge fueled by fading recession fears.

Also on Thursday, the Dow Transportation Index (TRAN) hit a 52-week high. Historically, the transportation index has served as an early indicator of strengthening economic conditions. The synchronized breakouts of the Industrials and Transportation indices (made new 52-week highs)is viewed as confirmation that a bull market is intact, and poised for further highs.

I recalled a veteran technical analyst once said, a bull market is not a bull market until the TRAN (Dow Transportation Average) joins the bull. The long-awaited Dow Theory bull market signal finally arrived this week. This came about as a result of the Dow Jones Industrial Average and the Dow Jones Transportation Average both breaking through their previous rally peaks. Although the breakouts provide confirmation of the nascent uptrends, one may question the relevance of the averages as representative benchmarks in the modern economy.

I would add: at the least, a break-out of the Dow Jones Transportation Average provides affirmation on the health of the economy.

Nasdaq composite, Dow Transportation, S&P500, Dow Industrial: % gain since Oct 12, 2022

The CME futures priced in a 99.2% probability of a 25bp rate hike on July 26, and widely expected to be the last rate hike. The ECB is expected to raise benchmark interest rate to 3.75% on July 27, (the highest since 2001, and the highest since the inception of the Euro).

All data as of July 21, *1 as of July 20

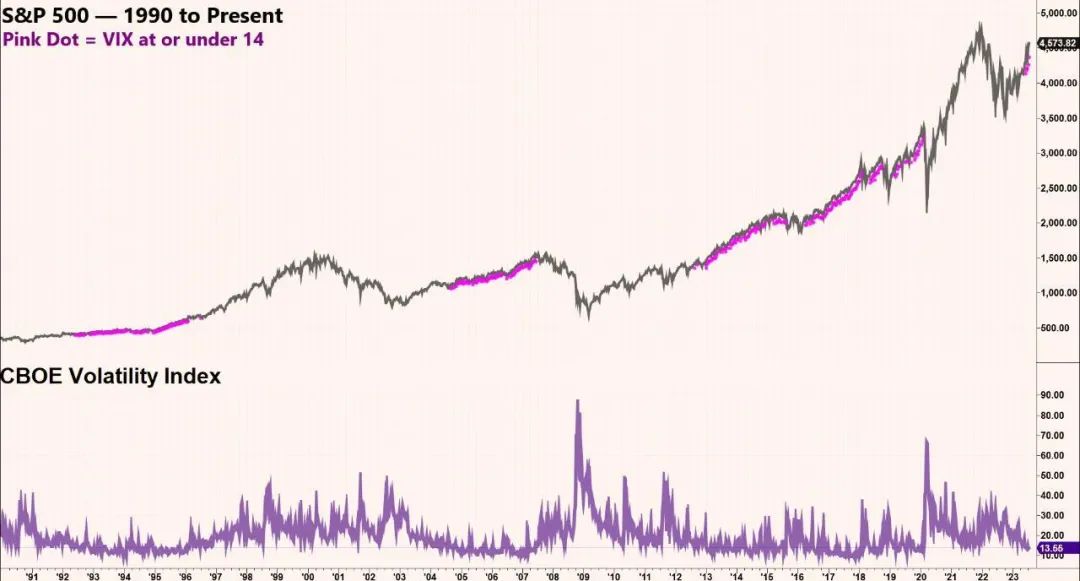

The CBOE VIX index (aka fear index) has recently hit the lowest level since Jan 2020 (the month before the Covid-19 pandemic). Some have argued that since the “vol” (volatility) is so low, there is only downside risk (ie: “vol” spikes up and market corrects/crashes). We need to remember, “vol” does not spike up for no reason. A significant spike in “vol” is invariably due to market dislocation triggered by exogenous events (predicting the next pandemic or a nuclear war) whichwe cannot factor in investing.

How about a scenario where-by the VIX stays low for an extended period? Going back to the inception of VIX index (1990), an extended period of low “vol” (under 14) has always coincided with long-term bull markets. Would you bet this time it is different?

In fact, a low “vol” environment for equities, currencies, and interest rates are positive tailwinds for risk assets.

Bank of America Q2 net income rose 19% to US$7.41 billion vs $6.25 billion in Q2 2022. Revenue increased 11% to $25.2 billion. Bank of America delivered superior Q2 results with a unique combination of main street and Wall Street businesses.

“Erica” is a Bank of America’s in-house developed virtual assistant that assists consumer banking customers interactively with tasks such as sending money, accessing account information, making on-line payments, etc., with great efficiency. The personalized, interactive, and proactive insights now account for 60% of customer engagement. According to Bank of America, clients have engaged with Erica more than 333 million times in the first six months of 2023.

In addition to “Erica,” Bank of America relied on digital platform for cost efficiency. For Q2, digital households account for 83% of the bank’s relationships. The bank now has 46 million active consumer user clients, digitally engaged with the bank’s digital platform over a billion times a month.

For a bank operating a nationwide branch banking network, cost efficiency means bottom line profit, and technology helps to power the seamless operation. Bank of America has reduced the number of branches from 3,984 a year ago to 3,887 at the end of Q2 (and from 4,341 five years ago) while adding 157,000 consumer clients over the past 12 months.

For those of us who still doubt that digital tools and AI can take jobs away, please think again.

Source: Bank of America Q2 2023 financial results presentation

Microsoft stock price has gained 1000% over the past 10 years (1225% with dividend reinvestment). 10 years ago, the investment community considered Microsoft a mature tech company with its best days behind it. WRONG!! The company has continued to reinvent beyond the Windows operating system. Cloud computing was a huge success. Azure took computing from cloud to the edge computing, especially as every application became AI-powered. The upcoming US$75 billion acquisition of Activision Blizzard would expand the company into interactive entertainment field (and metaverse!). The latest transformation is AI. Microsoft muscled its way into AI in January with a US$10 billion investment in OpenAI, the parent company of AI chatbot ChatGPT.

Microsoft shares hit a record high on Tuesday after the tech giant released higher prices ($30 a month) for its new artificial intelligence subscription service, called Copilot, for Microsoft 365. The stock is now up 50% for the year, reflecting investors’ bullishness over Microsoft’s investment in ChatGPT maker Open AI. Copilot is a generative AI assistant intended to complement Microsoft’s suite of office programs, is said to be able to summarize users' unread emails, reformat PowerPoint bullets, and write drafts based on outlines on demand, to name a few.

We can expect Copilot to take away MANY of “office” (administrative, clerical, analytics related)jobs.

The world has changed, and will continue to change, at an exponential pace.