每周全球金融观察 | 第 146 篇:市场保持非理性的时间比你偿付能力的时间更长

来源:岭南论坛 时间:2023-07-11

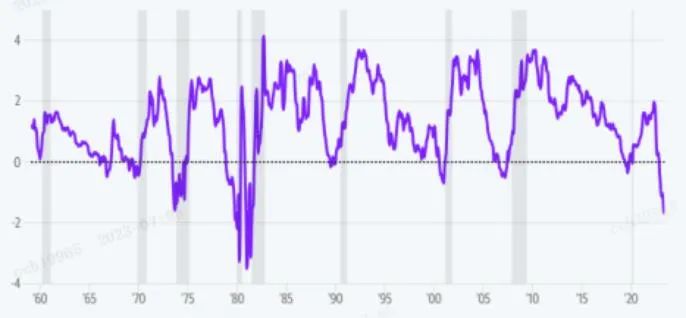

2023 年美国经济和股票市场的强势让很多经济学家、战略家和专业预言家感到困惑,他们指出了与过去经济衰退和股票下跌前的相似之处。持续的通货膨胀,美联储加息,收益率曲线倒挂,企业盈利下降,都是看跌的信号。也许 "这一次是不同的"。所有互联网创新的经济结构,加上 Covid-19 的转变,旧的经济和预测模型可能不再适用于新的 "新世界"。

周四,ADP(一项私人调查)报告显示,6 月非农就业人数大幅增加 49.7 万,5 月为 27.8万,预测为25万。在2023年下半年多次加息的预期下,股票和固定收益市场重新定价,道指、标普和纳指当天分别下跌 1.07%、0.79%和 0.82%,2 年期和 10 年期美国国债收益率分别飙升至 4.99%和 4.05%。

周五,BLS(劳工统计局)的官方 6 月非农就业报告为增加 20.9 万人,而预测值为 22.5万人(这是 15 个月以来就业数字首次低于预测值),低于 5 月的 30.6 万人。5 月份的数字从上个月报告的 33 万修订为 30.6 万。4 月份的数字被修正为降低了 7.5 万。虽然不热,然而,劳动力市场的运行仍然是温多于冷。

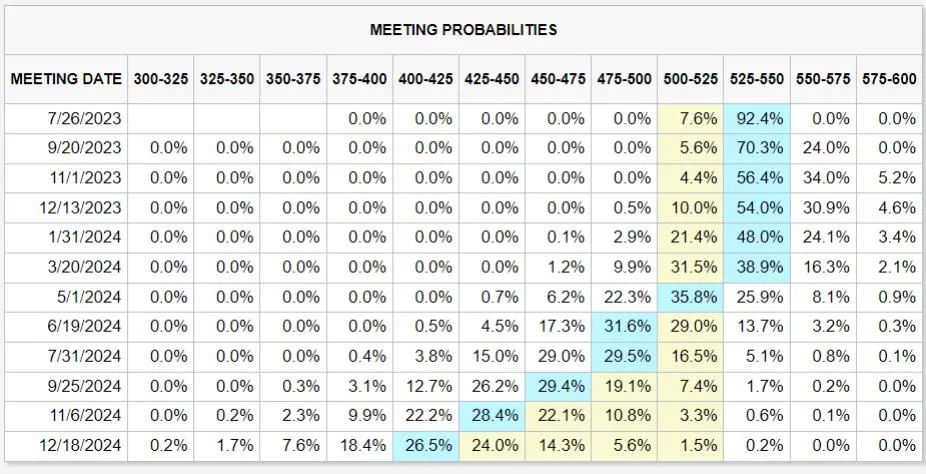

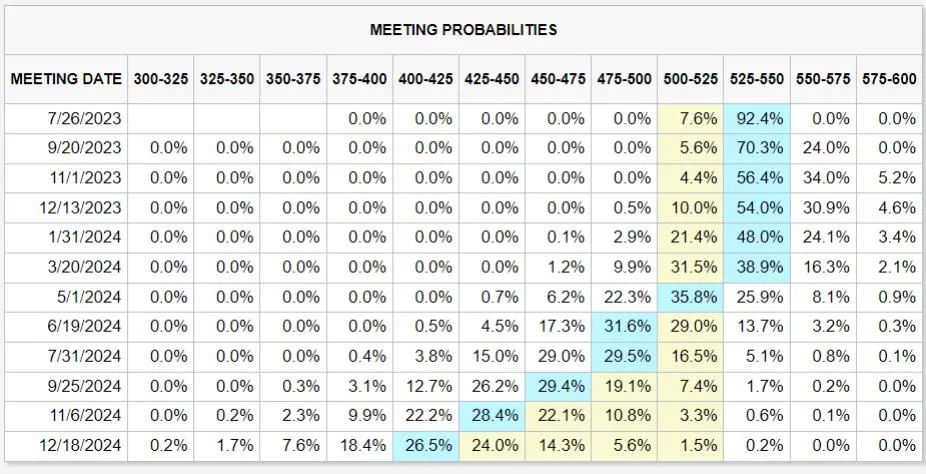

周五的报告很可能会使美联储在 7 月 28 日按下 "继续 "按钮而不是 "暂停 "按钮,除非 7月 12 日的 CPI 报告明显低于预测。截至周五,CME 期货市场对 7 月 26 日加息 25bp 的概率为 92%,然后在 2014 年 5 月开始的降息前会有一个长期的暂停(总是在六个月之后?)

本周华尔街有一个新的口号 "永远不要在 ADP 上交易"。周四的 ADP 数据差异将无一例外地损害其可信度,其报告被打上了非农就业报告(BLS 的官方非农报告)的不良引线。

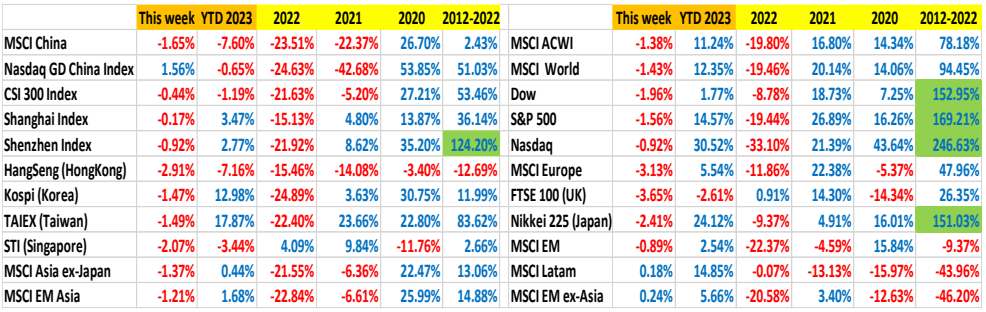

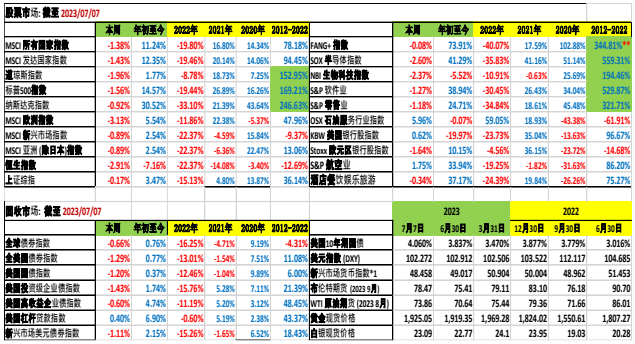

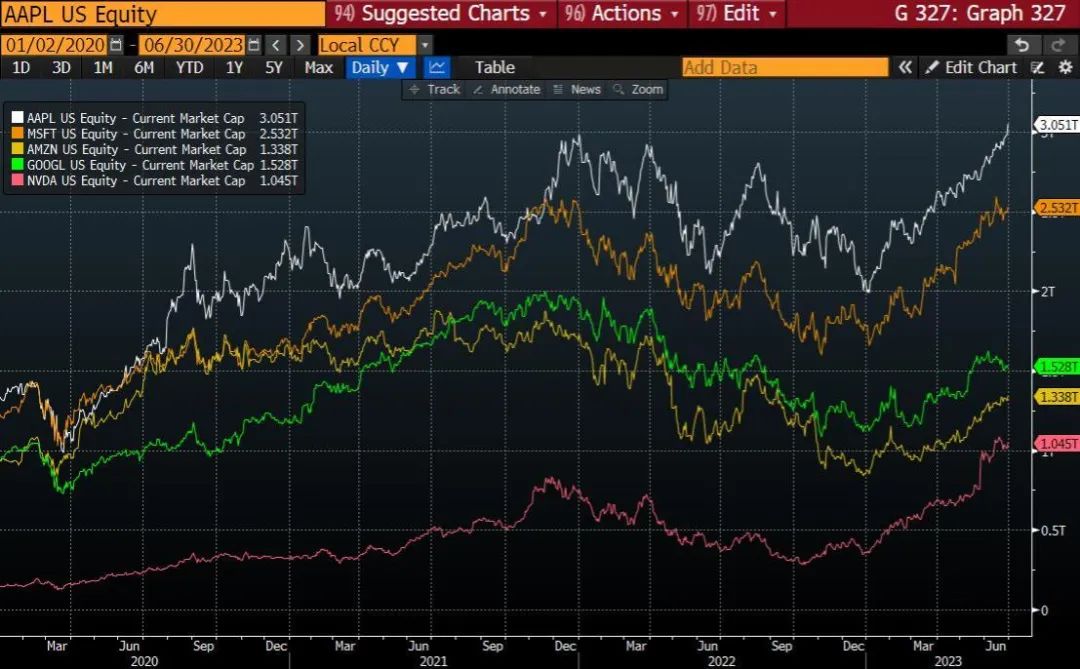

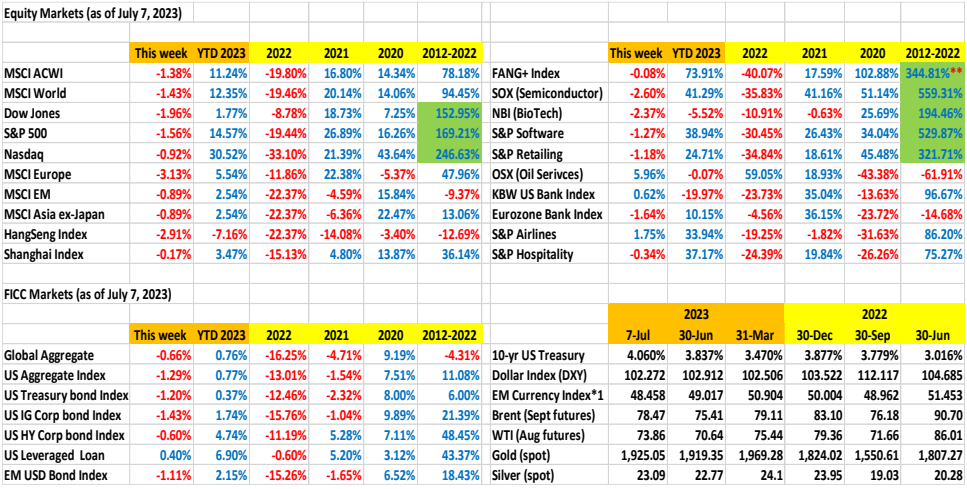

请参考下表,了解 2023 年全年的表现与往年的对比:

所有数据截至 7 月 7 日, *1 截至 7 月 6 日

我们该何去何从?

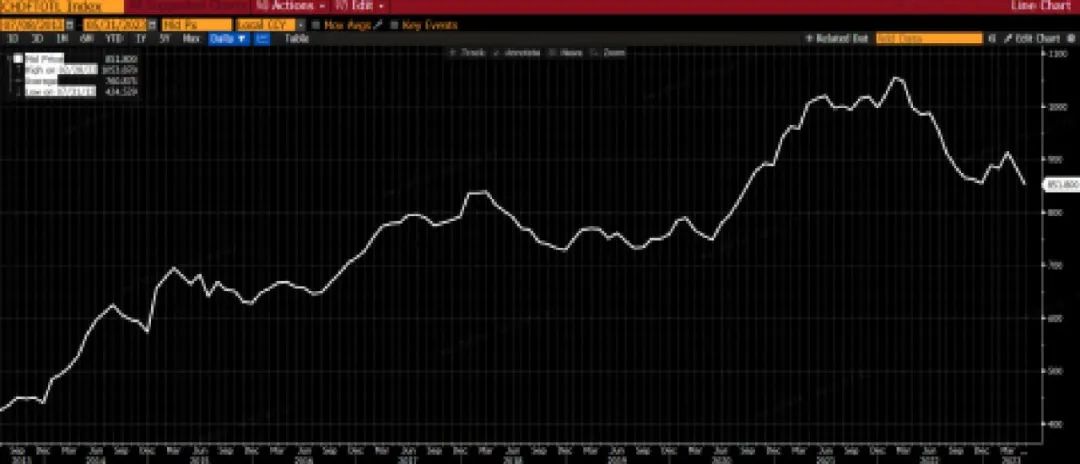

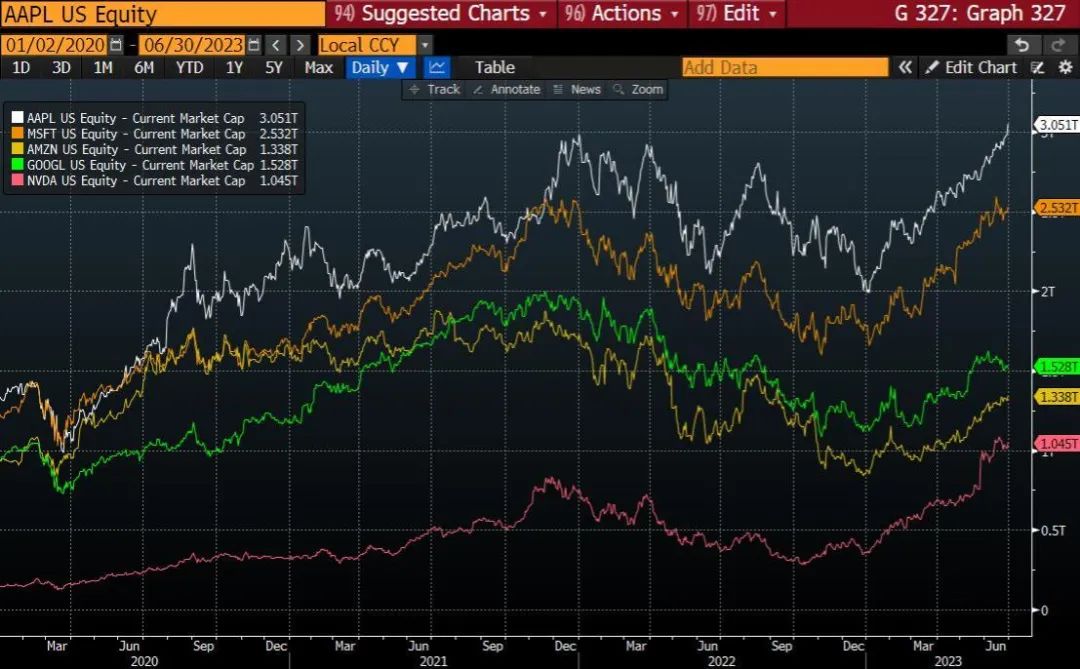

万亿美元俱乐部:

美国有五家公司的市值超过 1万亿美元:苹果、微软、谷歌、亚马逊和英伟达。特斯拉和Meta(以前的 Facebook)跨越了 1 万亿美元的大关,但已经下降到 1 万亿美元的市值以下。在上周的第 145 号文章中,我错过了一家美国以外的公司------沙特阿美石油公司,市场规模为 7.82 万亿里亚尔(约 2 万亿美元)。我非常幸运和自豪地有机会参与 2019 年沙特阿美的IPO,这是历史上最大的IPO,我是亚洲少数几个不从事石油业务的人之一,曾去过达兰 Dhanran(沙特阿美石油公司总部所在地)和 2019 年 12 月 11 日在利雅得的沙特阿美上市仪式。

市值:苹果、微软、谷歌、亚马逊、英伟达:

货币(外汇)市场:

榊原英资 Eisuke Sakakibara(1997 年至 1999 年日本副财政部长)周五发表评论称,由于日本银行坚持超宽松政策,而美联储、加拿大央行、欧洲央行、英国央行则提高利率以打击通货膨胀 (并可能在很长一段时间内保持较高利率), 日元可能会跌穿其去年达到的 30 多年的低点(超过 160)。榊原因其影响日元汇率的能力以及退休后对日元汇率的正确预测而获得了一个绰号(日元先生)。

二战后,日元对美元的汇率被设定为 360(圆型硬币的翻转?)随着日本经济的复苏,360 的汇率并不适用,但还是保持了几十年不变。疲软的日元帮助推动了日本的出口经济和对外经济(国民生产总值)。1985 年 9 月 22 日(广场协议)之后,一切都变了,剩下的就是历史了(失去的三十年)。从 2022 年 1 月 1 日到 2022 年 11 月 4 日,日元对美元贬值 27.41%,然后在干预和对美联储转向的预期中出现了复苏。利率差异不断加大 "长期走高 " 可能会再次改变动态,而日元先生很可能会再次被证明是正确的。

有同样利率差异困境的国家将面临与日本一样的货币压力,但是否有替代方案(或 TINA,There Is No Alternatives)?

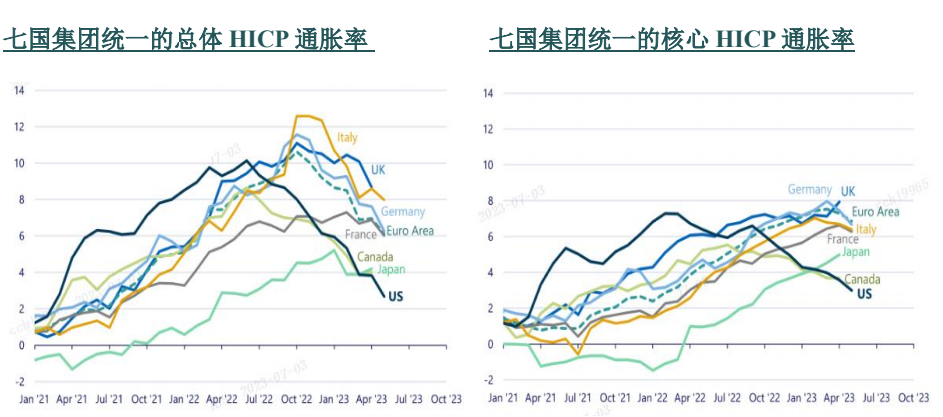

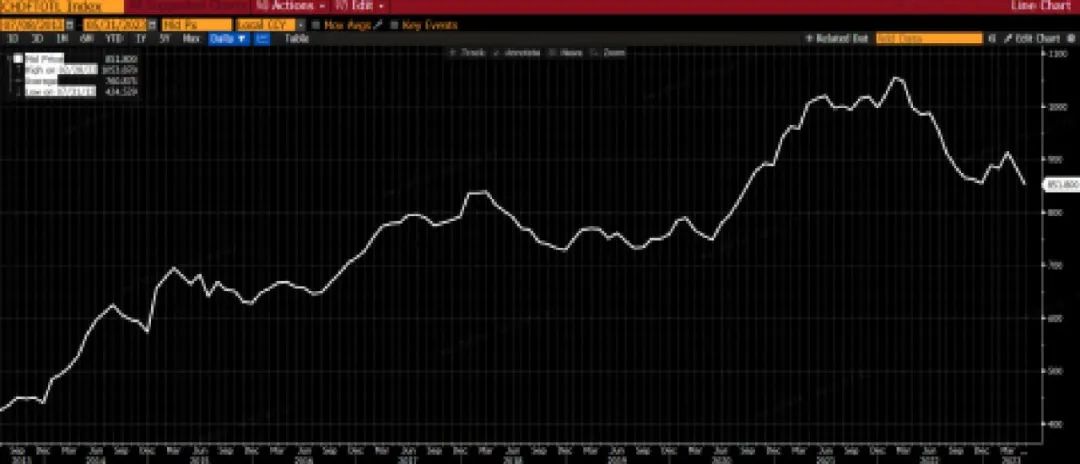

中国的外币存款:

我在彭博社找到了以下 "中国在岸外币存款"。不确定我是否找到了正确的数据,因为自2022 年以来的下降线在直觉上似乎并不正确(另外,有一篇 FT 文章引用了中国在当地商业银行积累了 3 万亿美元的 "非官方外汇储备 "https://www.ft.com/content/7172d136-dd14-404a-8a5c-92125af2b24e?shareType=nongift)。彭博社的另一篇文章引用了中国4530 亿美元的企业美元存款(这意味着中国有 4000 亿美元的零售存款。本周,国内银行将一年期零售存款利率从 4.5%-5%降至约 2.8%。

货币政策、利率和全球固定收益市场:

全球货币政策存在明显的分歧,美联储接近目前加息周期的尾声(也许还有一次加息,或者总是还有一次?),而欧元区特别是英国还有更多的加息。

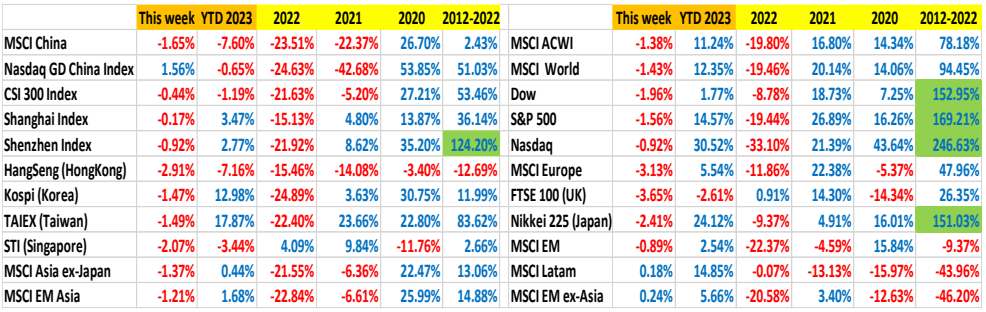

由于方法上的差异,比较各国的通货膨胀并不直接,然而,白宫的经济顾问委员会构建了一个统一的通货膨胀指数,以创造一个更清晰的主要经济体之间的比较,采用欧元区相同的 HICP 方法。

这一协调指数显示了美国的通胀率在整个 2021 年和 2022 年都是先上升和达到顶峰,现在的下降幅度低于所有其他 G7 国家。除了比其他 G7 国家更多地降低通货膨胀率外,美国还拥有 Covid-19 后最强劲的复苏,其实际 GDP 自 2019 年第三季度以来增长超过 5%。

资料来源:白宫经济顾问委员会

西方经济体的利率可能会在更长时间内保持较高的水平,全球利率分歧可能会在更长时间内保持较大,超过我们的痛阈。只要记住 "长期走高 " “higher for longer” 和 "全球分化 " “global divergence” 这两个流行语就可以了。

我记得凯恩斯 John Maynard Keynes 说过一句令人难忘的话:"市场保持非理性的时间比你保持偿付能力的时间更长"。请注意,凯恩斯用的是 "比你能保持偿付能力 "这个词,而不是 "比我们能保持偿付能力"。请确保这个 "你 "不是你。

作者:蔡清福

Alvin C. Chua

2023 年 7 月 8 日, 星期六

东亚和中国股票市场的表现与全球同行的比较:

Article #146: Markets can remain irrational longer than you can remain solvent

The strength of the US economy and the equity market in 2023 have confounded plenty of economists, strategists, and professional prognosticators, who point to parallels with past periods preceding recessions and stock declines. Persistent inflation, Fed rate hikes, inverted yield curve, and declining corporate earnings are all bearish signals. Perhaps "This time isdifferent". The structure of the economy with all the internet innovations, together with the Covid-19 pandemic transformation, the old economic and forecasting models may no longer be applicable in the new “new world”.

On Thursday, ADP (a private survey) reported a whopping 497,000 increase in June non-farm payroll, compared to 278,000 in May and forecast of 250,000. The equity and fixed income markets repriced with expectations of multiple rate hikes in 2H 2023, with Dow, S&P and Nasdaq off 1.07%, 0.79% and 0.82% respectively for the day, and the 2-yr and 10-yr UST yield popped to 4.99% and 4.05% respectively.

On Friday, the official June non-farm payroll report from BLS (Bureau of Labor Statistics) was an increase of 209,000, compared with forecasts of 225,000 (It is the first time in 15 months that the jobs figure has come in below forecasts) and down from 306,000 in May. The May figure was revised from the 330,000 reported last month to 306,000. The April figure was revised lower by 75,000. Although not hot, nevertheless the labor market is still running more warm than cool.

The Friday report likely will swing the Fed to press the “play” button instead of the “pause” button on July 28, unless the July 12 CPI report is significantly lower than forecast. As of Friday, the CME futures market is pricing in a 92% probability of a 25bp rate hike on July 26, and then a long pause before rate cuts starting in May 2024 (always six months away?).

There is a new slogan on Wall Street this week “Never Trade on ADP”. The ADP data discrepancy on Thursday will invariably damage its credibility, its report being branded as a poor lead on NFP (the official non-farm payroll report by BLS).

There are five companies in America with over US$1 trillion market cap: Apple, Microsoft, Google, Amazon, and Nvidia. Tesla and Meta (previously Facebook) crossed the US$ 1 trillion mark, but have declined below the $1 trillion capitalization. In article #145 last week, I missed a company outside of America - - Aramco, with market cap of SAR 7.82 trillion (about US$2 trillion). I have been tremendously fortunate and proud to have the opportunity to participate in the Aramco IPO in 2019, the largest IPO in history, and one of few people in Asia who is not in the petroleum business having been to Dhahran (where Aramco headquarter is located) and to the Aramco listing ceremony in Riyadh on Dec 11, 2019.

Eisuke Sakakibara (Japan’s vice finance minister from 1997 to 1999) made a comment on Friday that the Yen may fall through the more-than three-decade low it reached last year (to beyond 160) as the Bank of Japan clings to ultra-easy policy while the Fed, BOC (Bank of Canada), ECB, BOE (Bank of England) raise interest rates to combat inflation, and likely to leave higher rates for an extended period. Sakakibara gained the nickname (Mr. Yen) for his ability to influence the Yen exchange rate, as well as correctly predicting the Yen exchange rate after his retirement.

Post WWII, the yen exchange rate to the USD was set at 360 (a flip of the round shaped coin?). As Japan’s economy recovered, the 360 was not applicable, but nevertheless remained unchanged for decades. The undervalued Yen helped to propel Japan’s export economy and external economy (GNP). Everything changed after Sept 22, 1985 (Plaza Accord) and the rest is history (three lost decades). From Jan 1, 2022 through Nov 4, 2022, the Yen devalued 27.41% against the USD, amid increasing interest rate differential, then came the recovery, amid intervention and expectation of Fed pivot. “Higher for Longer” may change the dynamics again, and Mr. Yen quite likely will be proven right again.

Countries having the same interest rate differential dilemma will be facing the same currency pressure as Japan, but is there an alternative (or TINA, There Is No Alternatives)?

I found the following “China on-shore foreign currency deposits” in Bloomberg. Notsure if I found the correct data as the descending line since 2022 does not seem intuitively correct (separately, there was a FT article quoting China has accumulated US$3 trillion of “unofficial foreign currency reserves” in local commercial banks https://www.ft.com/content/7172d136-dd14-404a-8a5c92125af2b24e?shareType=nongift). A separate Bloomberg article quoted US$453 billion of corporate US dollar deposits in China (which means there are US$400 billion of retail deposits in China. This week, domestic banks slashed one-year retail deposit rate to about 2.8% from 4.5%-5%.

Monetary Policy, Interest Rates and Global Fixed Income Markets:

There is a notable global monetary policy divergence, with the Fed near the end of the present rate hike cycle (perhaps one more hike, or always one more to go?), while the Eurozone and particularly the UK have more rate hikes to go.

Comparing inflation across countries is not straight forward due to methodological differences, however, the White House’s Council of Economic Advisers has constructed a harmonized inflation index to create a clearer comparison across major economies, adopting the same HICP methodology as the Eurozone.

This harmonized index shows how inflation in the US both rose and peaked first throughout 2021and 2022, and has now declined lower than all other G7 countries. Along with managing to bring down inflation more than any other G7 nation, the US has also had the strongest recovery post pandemic, with its real GDP having increased more than 5% since Q3 of 2019.

Interest rates in the Western economies are likely to remain higher for longer, and global interest rate divergences are likely to remain larger for longer, than our threshold of pain. Just remember the buzz words “higher for longer” and “global divergence”.

I recall a memorable quote from John Maynard Keynes “Markets can remain irrational longer than you can remain solvent”. Please note, Keynes used the word “than you can remain solvent” and not “than we can remain solvent”. Please ensure the “you” is not you.