每周全球金融观察 | 第 145 篇:2023 年下半年市场会对我们友好吗?

来源:岭南论坛 时间:2023-07-04

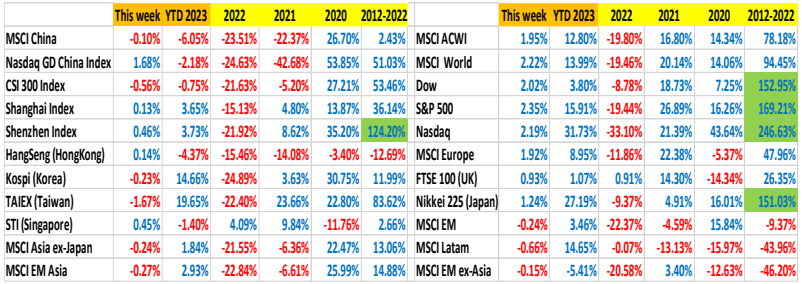

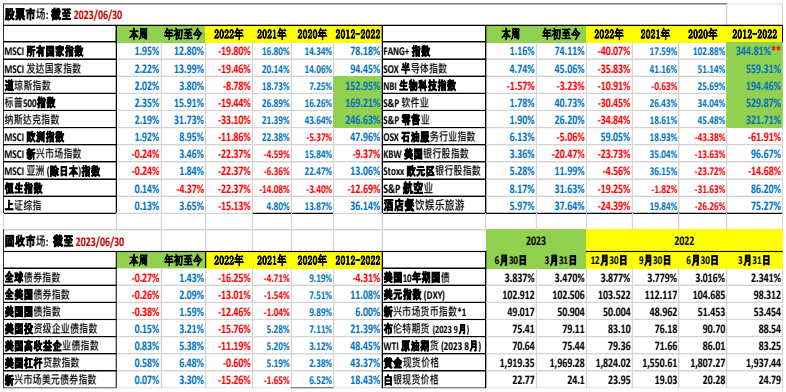

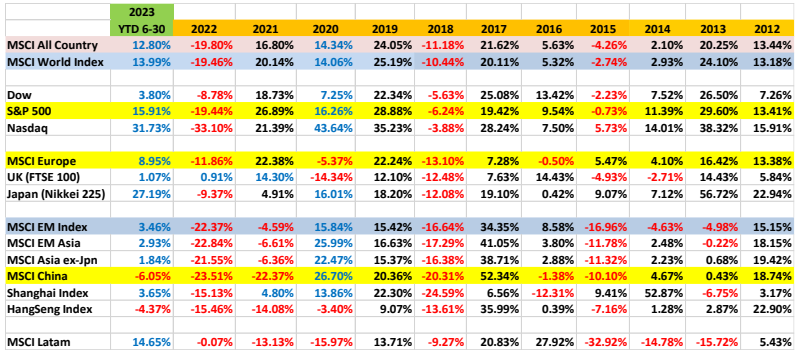

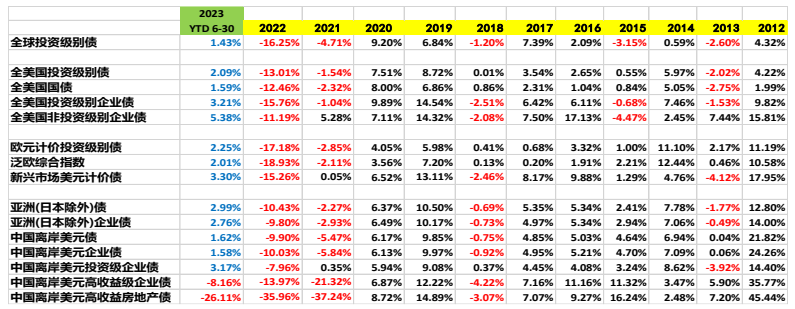

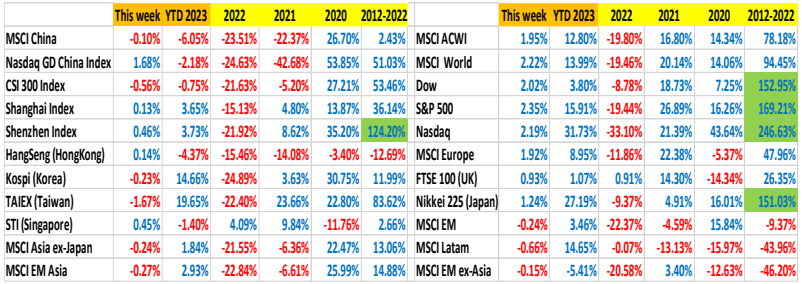

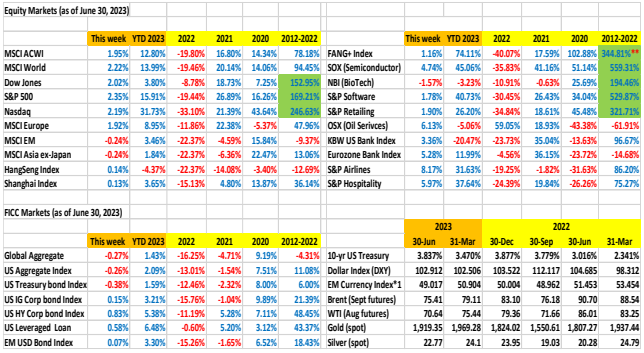

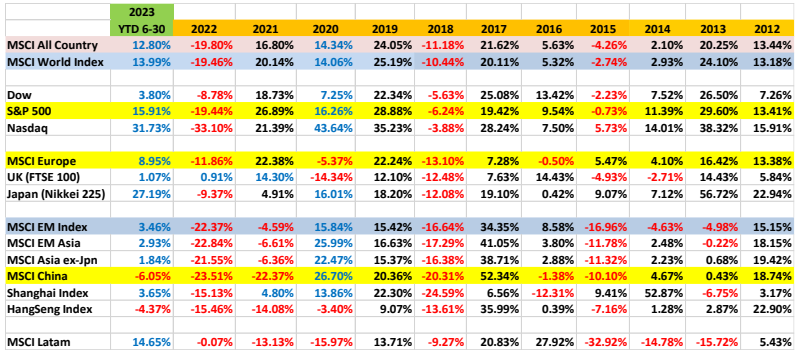

美国股市在欢呼声中结束了 6 月的最后一天,并在 2023 年上半年的篇章中,以一个辉煌的月份和辉煌的半年结束。今年前六个月,标准普尔 500 指数和纳斯达克指数分别上涨了15.91%和惊人的 31.73%,6 月份的收益分别为 6.47%和 6.59%。事实上,纳斯达克综合指数创下了 40 年来的最佳前半年开局,也是 1972 年以来第三好的上半年。纳斯达克 100 指数上半年上涨 38.75%,SOX 半导体指数上涨 45.06%,FANG+指数上涨 74.11%。

在美国科技行业的欢呼声中,全球各地出现了明显的分化,日经 225 指数年初至今上涨了27.19%,而 MSCI 欧洲指数上涨了 8.95%,英国富时 100 指数以 1.07%的涨幅勉强高于水面,而 MSCI 中国指数和恒生指数分别下跌了 6.05%和 4.37%。

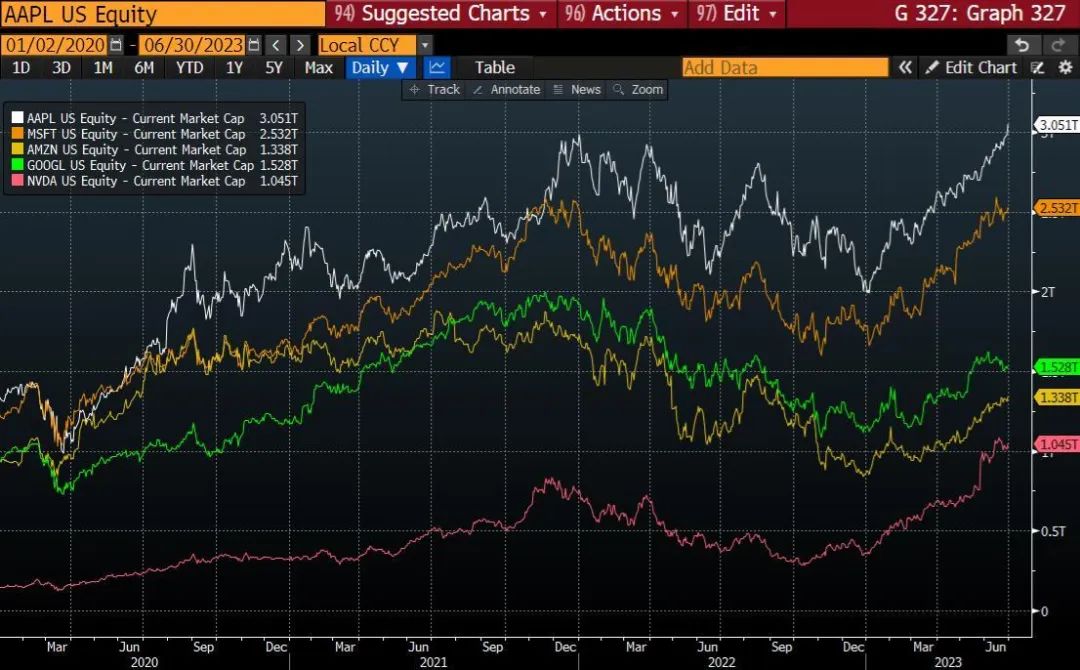

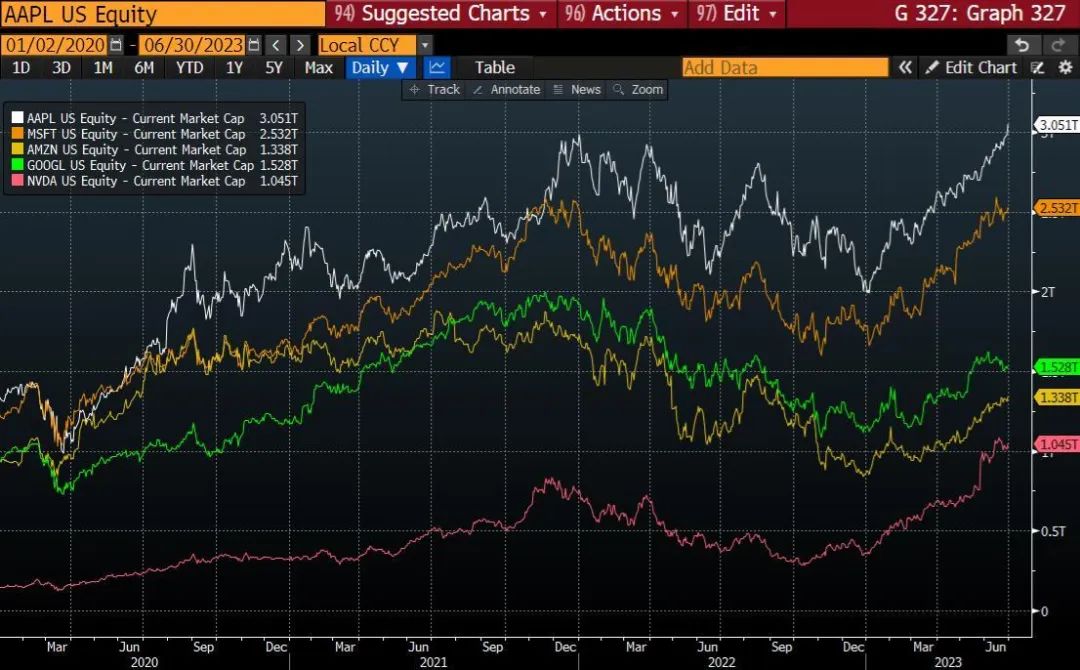

本周,苹果公司成为第一家跨越 3 万亿美元市值的公司。3 万亿美元的市值与英国(第六大股票市场)的股票总市值差不多,比德国(第七大股票市场)的市值更大。

世界上只有 5 家公司的市值超过 1 万亿美元:苹果、微软、谷歌、亚马逊和英伟达。特斯拉和 Meta(之前 Facebook 跨越了 1 万亿美元大关),但已经跌破了 1 万亿美元。

本周的市场繁荣是由本周一系列有利的经济数据推动的。值得注意的是,Conference Board 的消费者信心指数,6 月份上升到 109.7,而 5 月份是 102.5。

上周五,美联储首选的通胀指标 -- 5 月份个人消费支出平减指数年率为 3.8%,低于 4 月份的 4.3%。这是自 2021 年 4 月以来的最低数据,并大大低于 2022 年 6 月报告的 7.0%。这是一个可喜的趋势,但还是离美联储 2%的目标有一段距离(为什么是 2%,为什么不是2.5%或 3.0%?) 同样在周五,欧元区 6 月 CPI 初值报告为 5.5%,低于 5 月的 6.1%,是2022 年 1 月以来的最低水平,并明显低于 2022 年 10 月报告的 10.6%的峰值。欧洲央行也设定了 2%的核心通胀目标。

总的来说,这是全球股市的一个辉煌的上半年,但也出现了分化。美国科技板块领涨,纳斯达克综合指数创造了 40 年来最好的前 6 个月回报。美国股市的反弹并不局限于少数几只科技股。标普酒店业、航空业和零售业在 2023 年头六个月分别实现了 37.64%、31.63%和 26.2%的回报。小盘股罗素 2000 指数在上半年录得 7.24%的收益。

标普 500 指数在 2022 年 1 月 3 日创下历史新高,随后下跌超过 20%(熊市区域),并在10 月 12 日创下 2022 年的低点。2022 年 6 月 8 日,标普 500 指数恢复了 20.04%(自 10月 12 日的低点以来),并正式退出熊市,4 天后创下 52 周新高,并且没有回头。根据历史数据,标普 500 指数在退出熊市后有 90%的概率会走高(在未来 12 个月)。另外,从周五的收盘水平来看,8.27%的反弹将使我们回到 2022 年 1 月 3 日的历史高点。

在亚太地区,日经 225 指数在上半年取得了令人惊喜的 27.19%的回报。在大西洋彼岸,MSCI 欧洲指数取得了 8.95%的适度回报。

显著令人失望的是中国,MSCI 中国指数在上半年实现了-6.05%,而恒生指数为-4.37%。两年多来,全球投资界一直在减少中国的配置,并对中国进行减配。中国在 MSCI 新兴市场指数中的权重在 2020 年 10 月达到峰值 43.24%,一年后的 2021 年 10 月下降到 34.72%,到 2022 年 12 月进一步下降到 32.31%。到 2023 年 5 月,权重进一步下降到 29.2%。我必须指出,估值已经下降到不可抗拒的水平。对于有长期持有能力的投资者来说,在没有月度/季度业绩压力的情况下,回报与风险是很有吸引力的。

全球货币政策存在明显的分歧,美联储接近目前加息周期的尾声(也许已经跨越了周期),而欧元区,特别是英国还有更多的加息。

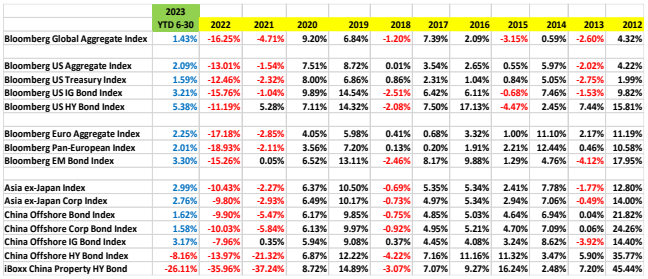

由于美国经济衰退(在未来 12 个月内)是一个低概率事件,美国信贷市场(包括投资级债券和高收益债券)提供了有吸引力的风险调整回报。值得注意的是,高收益债券信贷对总回报的贡献已经与无风险利率趋同,这对信贷来说是一个积极的信号。

然而,我对欧元区信贷市场不太乐观,相对于货币政策和通货膨胀,信贷利差太紧。

许多经济学家们对即将到来的美国经济衰退的预测一直是错误的,从一年前开始,他们总是说在三个月后,再三个月后,会有衰退。许多经济学家已经变得明显的沉默,少数人仍然呼吁 2024 年的经济衰退。许多市场专家也指出倒挂的收益率曲线(2 年期-10 年期美国国债利差周五为 106bp)作为即将到来的衰退的可靠指标。我从 2022 年 7 月起就一直认为,收益率曲线倒挂指标从 80 年代中期起就已经过时了,不再具有预测能力。

波动性(股票、利率和货币)一直在消退。特别是,VIX 指数波动率处于 2020 年 1 月以来的最低水平,这对风险资产类别来说是个好兆头。从历史上看,当我们处于低波动性状态时,它往往会持续下去,除非真正的“未知的未知”出现。由于 VIX 指数目前远低于平均水平,我们可以合理地预期,在真正的冲击到来之前,我们将处于低波动/良好回报的环境。

进入 2023 年,2022 年市场的痛苦记忆历历在目。大多数市场参与者带着根深蒂固的负面看法进入 2023 年,但厄运并没有发生 (硅谷银行可能造成灾难性后果,但果断的政策反应避免了潜在的灾难性后果)。我们中的许多人都忽视了改变投资格局和资产价格的因素。市场是动态的、相关的、多义的,需要不断地重新校准。我们需要重新校准风险因素与机会。投资成功的关键是认识到动态变化,抓住机会,并相应地调整我们的投资。

我想起 John Maynard Keynes 的一句名言:"当事实发生变化时,我就会改变我的想法--先生,你是怎么做的?"

祝你们在 2023 年下半年健康、快乐、成功。

作者:蔡清福

Alvin C. Chua

2023 年 7 月 2 日, 星期日

东亚和中国股票市场的表现与全球同行的比较:

Article #144: Will markets be kind to us in 2H 2023?

The US equity market finished the last day of June with jubilation, and closed the first half 2023 chapter with a banner month and a banner six month. For the first six months of the year, the S&P500 and Nasdaq gained 15.91% and a stunning 31.73% respectively, and the month of June gains were 6.47% and 6.59% respectively. In fact, the Nasdaq composite index registered the best six-month start in 40 years, and the third-best first half since 1972. The Nasdaq 100 index gained 38.75% in the first half, SOX semiconductor index gained 45.06% and the FANG+ index gained 74.11%.

The jubilation in the US Tech sector is marked by notable divergence across the globe, with the Nikkei-225 index gaining 27.19% YTD, while MSCI Europe gained 8.95%, the UK FTSE 100 barely above water with a 1.07% gain, while the MSCI China and the HangSeng index declined 6.05% and 4.37% respectively.

This week, Apple became the first company to cross the magic US$3 trillion market cap. The US$3 trillion market cap is about the same as the total stock market capitalization of UK (6th largest), and larger than that of Germany (7th largest).

For the record, there are only 5 companies in the world with over US$1 trillion market cap: Apple Microsoft, Google, Amazon, and Nvidia. Tesla and Meta (previously Facebook) crossed the US$ 1 trillion mark, but have declined below the $ 1 trillion capitalization.

The market exuberance this week was driven by a series of favorable economic data. Notably, the Conference Board consumer confidence index, which rose to 109.7 in June, vs 102.5 in May.

On Friday, the Fed’s preferred gauge of inflation -- the personal consumption expenditure deflator index for May was 3.8% YoY, down from 4.3% in April. It was the lowest reading since April 2021, and substantially lower than the 7.0% reported in June 2022. It is a welcoming trend, but nevertheless a distance from the Fed’s 2% target (why 2%, why not 2.5% or 3.0%?). Also on Friday, the preliminary Euro Area CPI report for June was 5.5%, down from 6.1% in May, the lowest level since Jan 2022, and significantly lower than the peak of 10.6% reported in Oct 2022. ECB has set a 2% core inflation target too.

Overall, it was a banner first half for global equities, with significant divergence. The US tech sector led the rally, with the Nasdaq composite index delivering the best first six-month return in 40 years. The US equity rally was not confined to a handful of tech stocks. The S&P hospitality industry, airline industry, and the retailing industries delivered 37.64%, 31.63% and 26.2% respectively for the first six months of 2023. The small cap Russell 2000 index delivered 7.24% in the first half.

The S&P 500 index made a new all-time high on Jan 3, 2022, and proceeded to decline over 20% (bear market territory), and hit the 2022 low on Oct 12. On June 8, the S&P 500 recovered 20.04% (since the Oct 12 low) and officially exited the bear market, setting a new 52-week high 4 days later, and not looking back. Based on historical data, there is a 90% probability that S&P 500 will be higher in the next 12 months (after exiting a bear market). Btw, an 8.27% rally from Friday’s closing level will bring us back to the Jan 3, 2022 all-time high.

Across the Pacific, the Nikkei-225 index delivered a pleasantly surprising 27.19% return in the first half. Across the Atlantic, the MSCI Europe delivered a moderate 8.95%.

The notable disappointment was in China, with the MSCI China delivering -6.05% in the first half, and the HangSeng index with -4.37%. The global investment community has been reducing China allocation and underweighting China for over two years. China’s weighting in MSCI EM index peaked at 43.24% in October 2020, and declined to 34.72% a year later in Oct 2021, and further declined to 32.31% by Dec 2022. By May 2023, the weighting further dropped to 29.2%. I must note, valuation has dropped to irresistible levels. For investors with long-term holding power, and without the monthly/ quarterly performance pressure, the reward vs risk is attractive.

There is a notable global monetary policy divergence, with the Fed near the end of the present rate hike cycle (perhaps already crossed the cycle), while the Eurozone and particularly the UK has more rate hikes to go.

With US recession (in the next 12 months) a low probability event, the US credit markets (both IG and HY) deliver attractive risk adjusted return. It is interesting to note that credit contribution to total return for HY has converged with risk-free rate, which is a positive signal for credits.

However, I am less sanguine with Eurozone credit market, with credit spread too tight relative to the monetary policy and inflation.

Many economists have been wrong with their impending US recession forecast, always with a “three-months away from a recession” since a year ago. Many have turned conspicuously quietlately, with a few still calling for 2024 recession. Many pundits have turned to the inverted yield curve (the 2yr-10-yr UST spread at 106bp on Friday) as a reliable indicator for impending recession. I have been arguing since July 2022 that the yield curve inversion indicator has been outdated since the mid-1980s, and no longer has the predictive power.

Volatilities (Equities, Interest rates, and Currencies) have been subsiding. In particular, the VIX index volatility is at the lowest level since Jan 2020, which bodes well for risk asset classes. Historically, when we are in a low-volatility regime, it tends to last unless a true “unknown unknown” comes along. With the VIX well below average now, we can reasonably expect to be in a low-vol/good return environment until a genuine shock comes along.

The painful memory of 2022 market massacre was fresh in our minds as we entered 2023. Most market participants carried an ingrained negative outlook into 2023, but the doom and gloom did not happen (SVB could have been catastrophic, but averted by decisive policy responses). Many of us have overlooked the factors that changed the investment landscape and asset prices. The markets are dynamic, correlated, and multinomial, and require constant recalibration. We need to recalibrate risk factors versus opportunities. The key to investment success is to recognize the changing dynamics, seize the opportunity, and to adjust our investments accordingly.

I recall a famous quote from John Maynard Keynes “When the facts change, I change my mind –what do you do, sir?”

I wish all of you a healthy, happy, and very successful second half of 2023.